Tired of handling expense documents, storing them in office space, and losing them? Expense management is challenging especially when you do it manually. That’s why using a digital solution such as expense management software sounds like a viable option.

What we cover

Why Use Expense Management Software?

Expense management software are end-to-end platforms that enhance the productivity of employees, automating various tasks, and streamlining financial operations.

Here are the key benefits of expense management software:

- Expense management software makes handling expense documents easier and eliminates the need for paper and storing docs.

- Expense management software reduces errors as everything is automated. It also reduces the chances of fraud done by companies or employees as all the details are available in the open on the software.

- Such software helps track expenses so companies can figure out which areas need improvement and balance. You come across trends to see where costs are high and where you can adjust more expenses.

- Expense management solutions automate reimbursement procedures, enhancing the overall financial situation of a company.

- An expense management system reduces the cost of paper, storage, and handling expenses. It reduces the burden of the financial team as well.

- Overall, the expense management system increases efficiency and productivity. With such solutions, you can prevent fraud, errors, and the need for paper.

General Pricing

Expense management software comes in various prices depending on the features you need. Some software are free of cost as well while others have a low fee such as $4.99/month. On the other hand, high-end expense management software costs hundreds of dollars per month but they are only suitable for large-sized enterprises.

The price of expense management software depends on the number of users and the size of your business. The more expenses you have, the more features you will need.

Moreover, the integrations of expense management software matter too. Some solutions might require additional charges for integrations.

Top Recommendations (At a Glance)

| Software | Tracking | Compatibility | Integrations |

| Precoro | Insightful Reports | Mac, Windows, Android, Linux | Xero, QuickBooks, NetSuite, Slack, etc |

| Zoho | Expense Report Management and Automation | Mac, Windows, Linux, Android, iPad. | QuickBooks, Xero, Sage, Bolt, Lyft, Uber, Slack, HSBC, Office365, etc. |

| Expensify | Receipt Tracking and Reports | Windows, Linux, Mac, Apple, Android. | Gusto, ADP, QuickBooks, Sage, Workday, NetSuit, Certinia, etc. |

| SAP Concur | Analytics and Insights | Windows, Unix, Mac | QuickBooks, S4/HANA, Axosnet, Datamap, etc. |

Best Expense Management Software – Let’s Dive Deeper!

Let’s check out detailed reviews of the best expense management software so you can make the right choice!

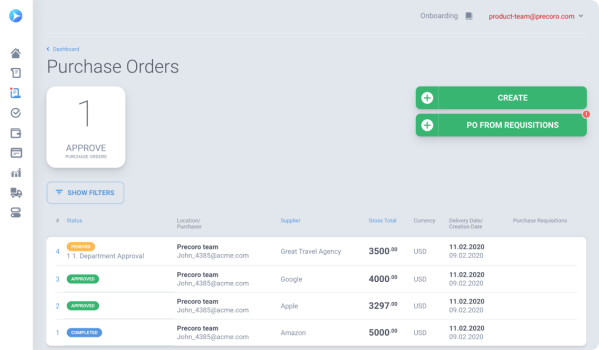

Precoro

Precoro is a procurement and expense management platform designed to streamline purchasing processes.

Key Features:

- Automated Purchase Order (PO) creation and approval workflows.

- Real-time budget tracking and control.

- Integration with accounting systems for seamless financial management.

Ratings: 4.5/5.

Pros:

- Efficient procurement process automation.

- Transparent budget monitoring.

- User-friendly interface.

Cons:

- Limited advanced reporting features.

- Initial setup may require assistance.

- Integration with some platforms may be complex.

Pricing: For teams with 20 or fewer users, the cost is $39 per user per month, billed annually.

Launched in 2014, Precoro revolutionizes expense management, freeing businesses from spreadsheet chaos. This automation powerhouse simplifies workflows, offering customizable approval processes and real-time analytics.

Its AI-driven Smart Receipt Capture and seamless integrations make it a finance team favorite. Ideal for businesses of all sizes and global operations, Precoro ensures efficiency and insightful decision-making.

While it may be extensive for very small teams, its benefits shine for those valuing streamlined workflows and data-driven insights.

Verdict: If manual expense management headaches plague you, Precoro is the answer, combining user-friendliness with powerful features.

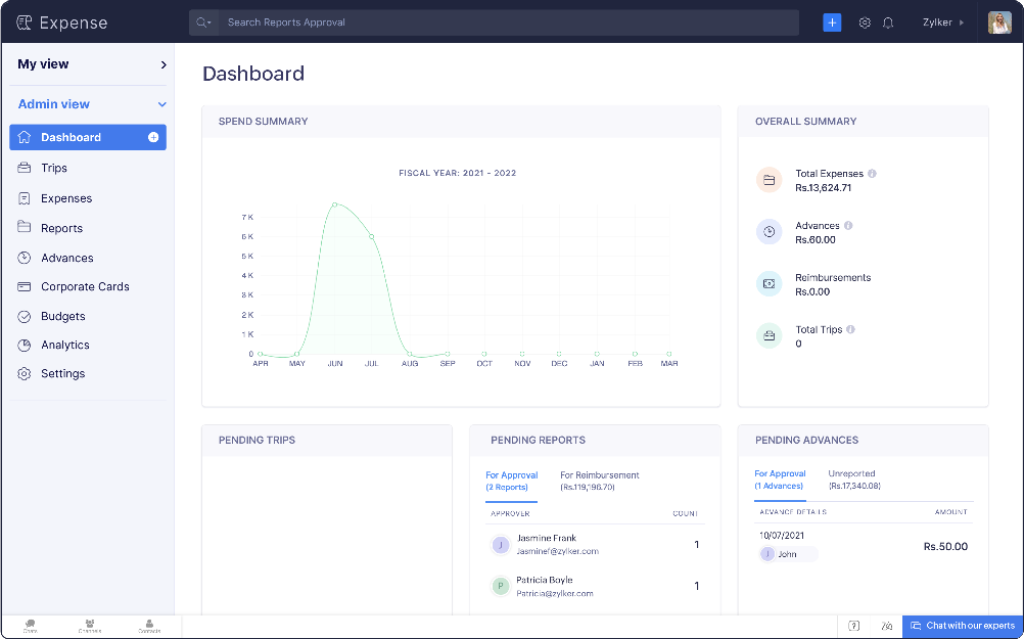

Zoho

Zoho Expense is a user-friendly expense tracking software that simplifies reporting and reimbursement.

Key Features:

- Receipt scanning and automatic expense report generation.

- Policy enforcement and real-time analytics.

- Integration with Zoho’s suite of business tools.

Ratings: 4.6/5.

Pros:

- Intuitive user interface.

- Efficient receipt management.

- Seamless integration with Zoho ecosystem.

Cons:

- Limited customization options for reports.

- Learning curve for new users.

- Some users report occasional glitches.

Pricing: Start your free trial with a minimum of 3 users at $6 per active user per month, billed annually.

Zoho Expense, introduced by software giant Zoho in 2011, is more than an expense management tool, it’s a Zoho superpower simplifying financial tasks within its ecosystem.

Businesses value its automation prowess, seamless integration, and customization options. The user-friendly interface, coupled with real-time insights and SmartScan Technology, makes it a go-to for streamlined expense management.

Ideal for Zoho users of all sizes, Zoho Expense provides efficiency and cost control, although its focus on integration might be excessive for those outside the Zoho ecosystem.

Verdict: Zoho Expense transforms financial tasks into a seamless experience, particularly for businesses already immersed in the Zoho world.

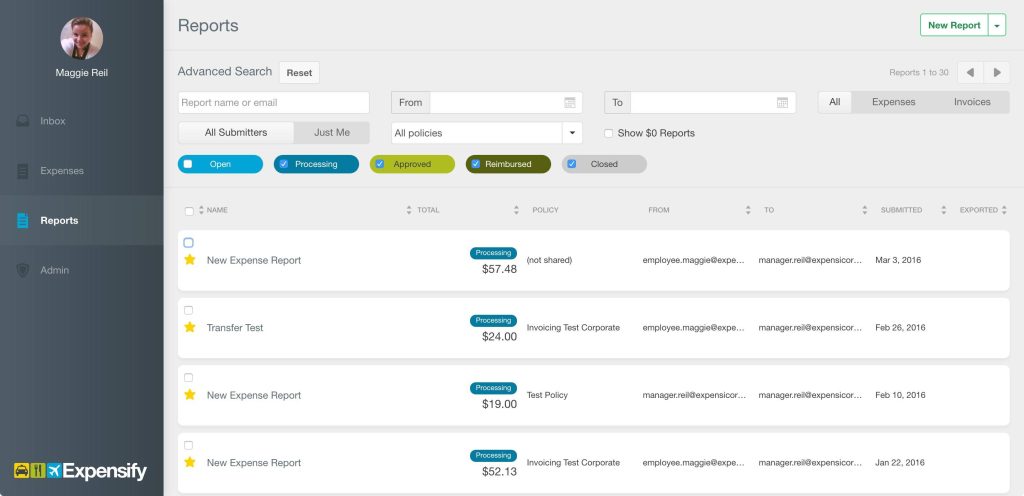

Expensify

Expensify offers a comprehensive expense management solution with features like receipt tracking and automatic report generation.

Key Features:

- SmartScan technology for automatic receipt capture.

- Corporate card reconciliation.

- Advanced policy enforcement and compliance checks.

Ratings: 4.5/5.

Pros:

- Excellent receipt scanning capabilities.

- Intuitive mobile app.

- Quick and easy expense reporting.

Cons:

- Higher pricing compared to some competitors.

- Limited customer support for lower-tier plans.

- Some users find the interface overwhelming.

Pricing: Starting at $5 per user per month with an annual subscription.

Expensify, founded in 2008, redefines expense management with a quirky charm, offering a mobile-first, gamified experience.

Known for its rebellious spirit against spreadsheet monotony, Expensify’s SmartScan Technology and automation streamline the process. Mobile mastery allows users to snap receipts effortlessly, while its gamified approach adds fun to expense tracking.

While it may not suit formal cultures or advanced reporting needs, its unique blend of personality and functionality makes it an endearing choice for those wanting a lighthearted approach to financial tasks.

Verdict: With customizable features and a touch of humor, Expensify caters to businesses of all sizes seeking an unconventional yet efficient expense management solution.

SAP Concur

SAP Concur is an integrated travel and expense management software designed for large enterprises.

Key Features:

- End-to-end travel and expense automation.

- Integration with ERP systems for financial visibility.

- Policy compliance and audit capabilities.

Ratings: 4.2/5.

Pros:

- Scalable for large enterprises.

- Robust reporting and analytics.

- Integration with other SAP solutions.

Cons:

- Complex setup and customization.

- Higher cost for smaller businesses.

- Some users experience occasional system glitches.

Pricing: Custom pricing based on business size.

SAP Concur, established in 1993 and later acquired by SAP in 2014, is not just an expense management tool but a comprehensive suite addressing financial complexities.

Integrating seamlessly with the SAP ecosystem, Concur automates expenses, travel, and invoices, providing real-time insights and global capabilities.

Designed for large corporations prioritizing deep integration, compliance, and risk mitigation, Concur offers scalability and robust features. While optimal for complex financial operations, it may seem overwhelming for smaller businesses with simpler needs.

Verdict: Its powerhouse capabilities make SAP Concur a heavyweight choice for enterprises seeking a unified solution to conquer financial challenges.

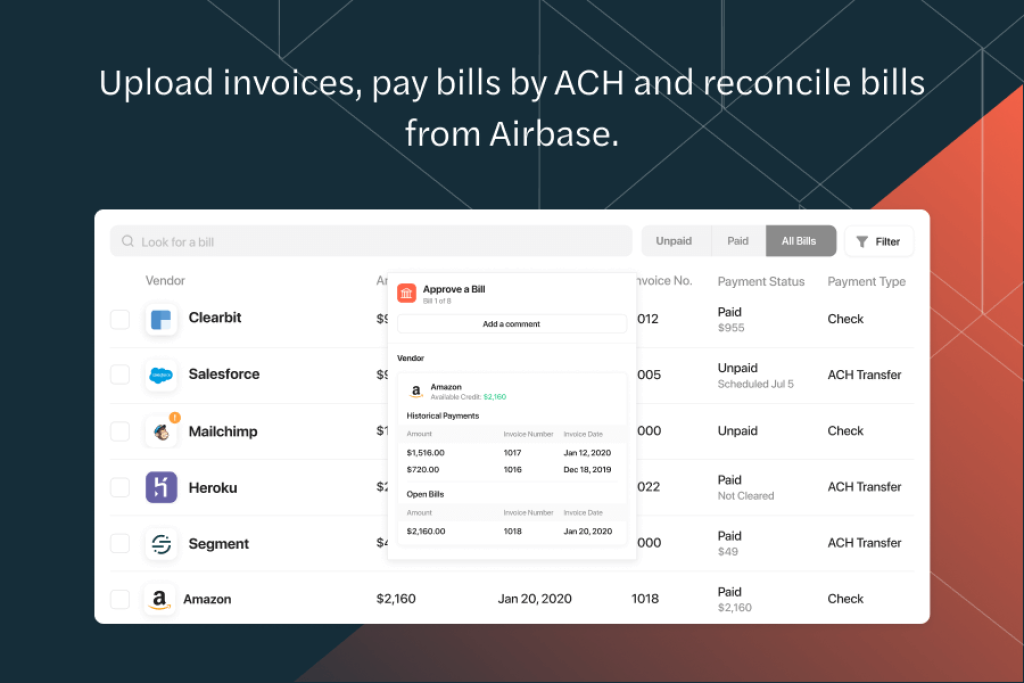

Airbase

Airbase is an all-in-one spend management platform that combines expense management, bill payments, and corporate cards.

Key Features:

- Automated approval workflows for expenses and bills.

- Virtual and physical corporate cards with customizable controls.

- Integration with accounting systems for seamless financial tracking.

Ratings: 4.7/5.

Pros:

- Comprehensive spend management features.

- Flexible card controls.

- User-friendly interface.

Cons:

- Initial setup may require assistance.

- Integration with some platforms can be improved.

- Pricing may be higher for smaller businesses.

Pricing: Custom pricing based on business size.

Launched in 2017, Airbase stands out as a sleek, modern contender in the expense management arena.

With a focus on simplicity and automation, it has gained popularity for its user-friendly platform and seamless integrations. Airbase’s smart features, such as automated receipt extraction and flexible spending rules, cater to businesses of all sizes.

Mobile mastery, real-time analytics, and a commitment to a unified financial ecosystem make it an ideal choice for those seeking a modern and intuitive approach to expense management.

Verdict: While not suitable for highly complex needs, Airbase’s clean design and smart automation make it a rising star in the expense management space.

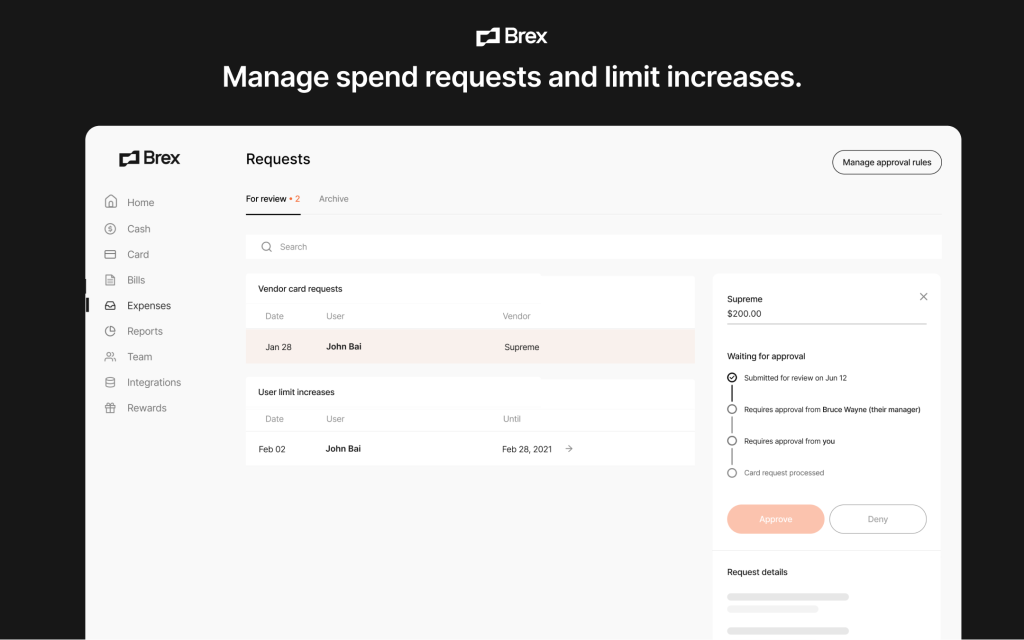

Brex

Brex offers a corporate card and expense management solution with features tailored for startups and scaling businesses.

Key Features:

- Instant card issuance and customizable spending limits.

- Integration with accounting software for real-time tracking.

- Rewards program for business spending.

Ratings: 4.6/5.

Pros:

- Quick card issuance.

- Streamlined expense tracking.

- Tailored for startup needs.

Cons:

- Limited to business customers in specific industries.

- Higher card fees compared to traditional banks.

- Limited international usage.

Pricing:

- Free Plan

- $12 user/month.

Launched in 2017, Brex transcends traditional expense management, serving as a growth catalyst with its smart corporate cards and intuitive software.

Ideal for startups and scaling businesses, Brex offers a seamless blend of flexible spending controls, automation, and real-time insights.

The smart card system empowers employees while maintaining control, and deep integrations with financial tools ensure a unified ecosystem. Brex’s commitment to simplifying finance for growing businesses makes it a top choice for those seeking streamlined workflows and financial efficiency.

Verdict: While it may be pricier for some, Brex stands out as a dynamic fuel injector propelling businesses toward heightened efficiency and growth.

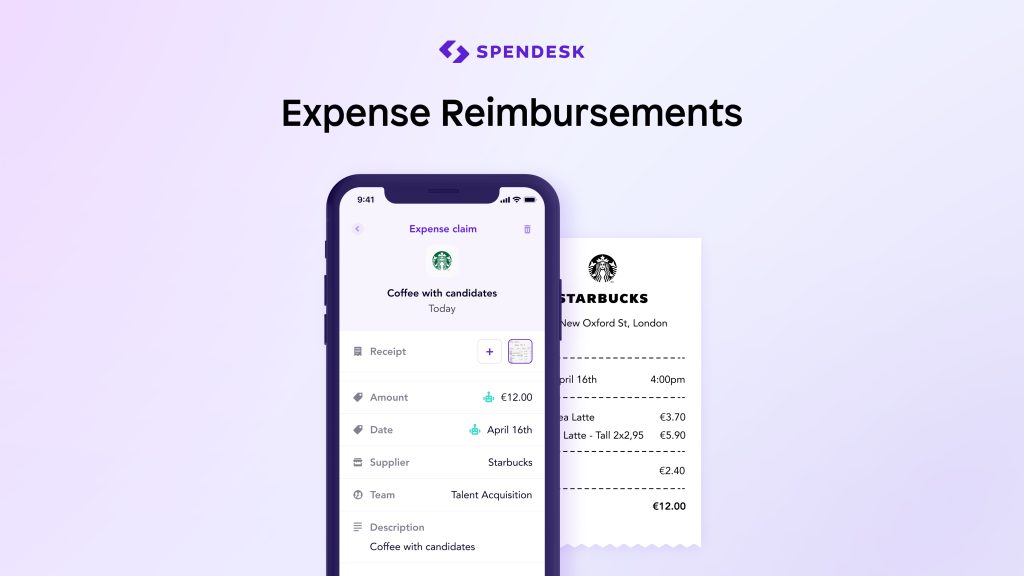

Spendesk

Spendesk is a spend management platform offering integrated expense reports, virtual cards, and invoice processing.

Key Features:

- Virtual and physical cards with spending controls.

- Automated expense report creation and approval workflows.

- Invoice processing and payment automation.

Ratings: 4.5/5.

Pros:

- Comprehensive spend management features.

- User-friendly interface.

- Integration with accounting systems.

Cons:

- Pricing may be higher for smaller businesses.

- Some users report occasional bugs.

- Limited advanced reporting features.

Pricing: Custom pricing based on business needs.

Launched in 2016, Spendesk orchestrates seamless expense management, emerging as a global leader with its emphasis on flexibility and user experience.

Ideal for businesses of all sizes, Spendesk’s virtual cards, automated workflows, and real-time insights redefine financial harmony. The platform empowers both finance teams and employees, offering tailored spending limits, intuitive budgeting tools, and multi-currency support for global operations.

Spendesk’s innovative approach to expense management makes it a top choice for those seeking a modern, adaptable solution that conducts financial processes to a new level of efficiency and satisfaction.

Verdict: While it may be pricier, Spendesk stands out as a financial conductor harmonizing the orchestra of business spending.

Abacus

Abacus is an expense management solution with real-time expense reporting and customizable policy enforcement.

Key Features:

- Real-time expense tracking and reporting.

- Automated policy enforcement and approval workflows.

- Integration with accounting and ERP systems.

Ratings: 4.4/5.

Pros:

- Quick and easy expense submission.

- Customizable policy enforcement.

- Integration with popular accounting software.

Cons:

- Some users report occasional glitches.

- Learning curve for administrators.

- Limited support for international currencies.

Pricing: $9 per active user per month.

Established in 2003, Abacus operates as a discreet expense management ninja, silently streamlining workflows and automating tasks.

Trusted by businesses of all sizes, Abacus seamlessly integrates with popular accounting software, offering real-time data insights and customizable workflows. As an automation ace, it eliminates manual tasks, while its real-time analytics empower informed financial decisions.

The platform’s compliance features, integration capabilities, and scalability make it ideal for those seeking a powerful, data-driven solution that quietly delivers financial peace of mind.

Verdict: While its functionality is robust, Abacus may be less engaging for those prioritizing a flashy user interface or mobile-first options.

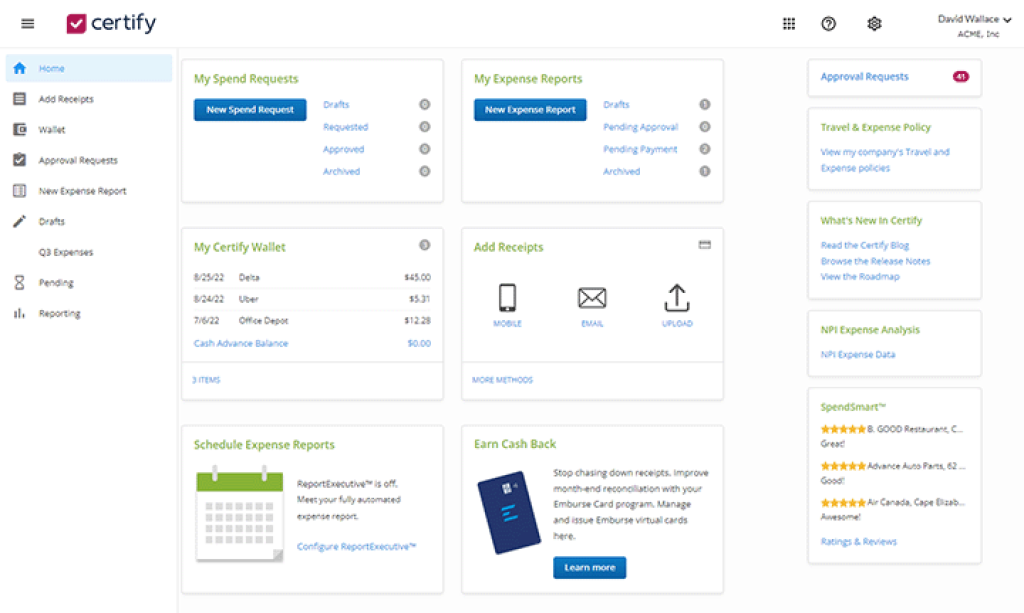

Certify

Certify provides a cloud-based expense management solution with features like receipt capture and travel booking.

Key Features:

- Receipt capture and automatic expense report creation.

- Travel booking and itinerary management.

- Integration with accounting and ERP systems.

Ratings: 4.5/5.

Pros:

- Easy-to-use interface.

- Seamless integration with accounting software.

- Efficient travel booking capabilities.

Cons:

- Pricing may be higher for smaller businesses.

- Limited customization options for reports.

- Some users report occasional delays in support responses.

Pricing: 1-25 employees – $12 per user/month.

Established in 1997, Certify stands as a financial superhero, transcending traditional expense management. Trusted globally for its robust features and seamless integration, Certify automates tasks, utilizes AI for deep insights, and adapts to unique business needs.

Its multi-language support and global capabilities simplify international operations, making it a go-to for businesses seeking financial clarity and control.

Certify’s SmartCapture technology and real-time analytics empower smarter financial decisions, catering to companies of all sizes.

Verdict: While its interface may seem complex for some, Certify’s magic lies in transforming expense chaos into control, making it an ideal financial ally for those embracing innovation and flexibility.

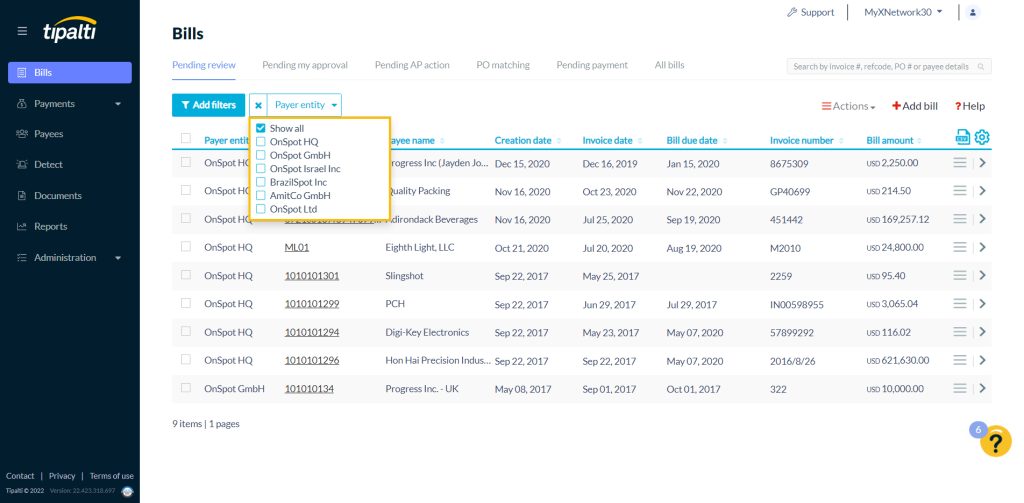

Tipalti

Tipalti is an automated accounts payable platform that includes features for expense management and global payments.

Key Features:

- Automated invoice processing and approval workflows.

- Global payment capabilities with compliance checks.

- Integration with ERP and accounting systems.

Ratings: 4.6/5.

Pros:

- Comprehensive accounts payable automation.

- Global payment capabilities.

- Robust compliance checks.

Cons:

- Pricing may be higher for smaller businesses.

- Learning curve for some advanced features.

- Limited flexibility in user interface customization.

Pricing: $129 per month for the platform fee.

Launched in 2010, Tipalti is not just an expense management tool; it’s a transformative potion for financial efficiency. A global leader in financial automation, Tipalti’s alchemical touch streamlines workflows and payments.

Trusted by businesses of all sizes, it automates tasks, supports multi-currency transactions, and enhances supplier relationships. Its real-time analytics provide instant insights, making it ideal for those seeking a future-proof approach to expense management.

With features like SmartFill technology and a vendor portal, Tipalti serves as a comprehensive, automated financial alchemist for companies embracing global operations and supplier networks.

Verdict: While its interface may seem complex for some, Tipalti’s magical touch lies in turning expense reports into golden efficiency.

How to Choose the Best Expense Management Software?

With so many options in the market, it is challenging to choose the best expense management software. That’s why you have to consider certain factors and make a list of features you need for your business before making a choice.

Integrations

Make sure the expense management software you choose integrates with all the previous software systems you use such as document management software. This way, you won’t have to upload different documents related to expenses and other details and reports regarding your business to the software.

Some software charges extra for additional integrations so you should go through the list of integrations the software offers at the original price.

Scalability

Expense management software should be scalable to accommodate the growth of your company. If software can only handle individual-level expenses, you shouldn’t be using it for a medium-sized enterprise.

The best way is to estimate the potential growth of your company. Then align it with the scalability of the software you choose. If it seems like a good fit, you can get the software for your business.

Data Security

Expense management software consists of legal documents, personal information, and private papers. That’s why the security system of the expense management system should be strong and reliable.

While transferring or uploading data to the expense management software, make sure it doesn’t lose any of it.

Features like private documents should be available on expense management software so that not everyone has access to every document.

Budget

Consider the features that you need in the expense management system. Then choose a software that has all those features while still fitting within your budget.

Usually, individuals and small businesses don’t need advanced features. So, you can go for free or inexpensive software systems.

On the other hand, large enterprises have huge budgets for software systems so they prefer going for high-end software. However, unless it is absolutely necessary, going for high-end software systems with tons of features that you aren’t going to use as a small business isn’t a suitable choice.

User Experience

The user interface should be friendly. The expense management system should be easy to use for all the employees so that they don’t have to spend hours trying to figure out how to use the software.

If needed, you can provide software tutorials to your employees available on YouTube or some other platform for the specific software you are going for. But initially, it should have a friendly user interface for all levels of employees.

FAQs

What is the Best Software to Keep Track of Business Expenses?

You can easily keep track of business expenses by using expense management software with their advanced features like real-time tracking, analytics, management, collaboration tools, integrations etc. Some examples of the best expense management software include:

- Precoro

- Zoho

- Expensify

- SAP Concur

- Airbase

Are there any Free Expense Management Software for Small Businesses?

Use free expense management software for small businesses ad they have all the required basic features you will need intially. Some examples of free expense management software include Zoho Expense, Expensify, Navan, and Divvy.