In the dynamic landscape of financial services, where advisors must manage a multitude of client interactions, portfolios, and compliance requirements, a robust CRM can be the linchpin of an efficient and thriving practice. The best CRM for financial advisors is one that not only simplifies contact management but also provides insights into client needs, integrates with other financial tools, and ensures a high level of customization to adapt to the specific workflows of a financial advisory firm.

Selecting the right CRM software is pivotal for advisors as it directly influences their capacity to manage client data effectively, automate tasks, and maintain communication with clients. Current market leaders include platforms that can seamlessly integrate with other software systems, offer intuitive user experiences, and deliver detailed analytics. Fostering strong client relationships and driving business growth, CRMs designed for financial advisors incorporate features such as compliance tracking, personalized client portals, and sophisticated alert systems to keep advisors abreast of important deadlines and events.

What we cover

Why Should Financial Advisors Use CRM Software

Here are five top benefits of using CRM software for financial advisors:

- Streamlined workflow, which enhances operational efficiency.

- Integration capabilities that consolidate client data for better service provision.

- Automation of mundane tasks, prioritizing productivity.

- Advanced reporting to shape data-driven financial insights.

- Improved tracking and management of client communication and leads.

Leveraging CRM software allows financial advisors to not only manage their current clientele but also to effectively expand their services due to the scalability provided by these systems.

General Pricing of CRM Software for Financial Advisors

Pricing for CRM software tailored to financial advisors varies widely, reflecting the range of features and scalability that different platforms offer. Here’s a concise overview:

Cost Range:

- Free Versions: Some providers offer basic CRM solutions at no cost, often with limited features ideal for individuals or small teams.

- Entry-Level Paid Options: Prices can start as low as $12 per user, per month for more comprehensive tools.

- Mid-Range Solutions: Typically, these cost between $50 to $100 per user, per month, adding enhanced analytics and automation.

- High-End Platforms: Monthly costs can exceed $200, catering to large firms with advanced data integration needs.

Free Trial Periods:

Most CRM platforms provide a free trial, with durations ranging from 15 to 30 days. This allows financial advisors to assess the software’s suitability.

Features to Look for When Selecting CRM Software for Financial Advisors

When financial advisors are in the market for Customer Relationship Management (CRM) software, several key features should stand out:

- Customization: The ability to tailor the CRM to fit the specific needs of a financial advisory firm is essential. Customizable dashboards, fields, and workflows allow advisors to focus on the most relevant client information.

- Compliance and Security: Advisors deal with sensitive financial data, making stringent security measures non-negotiable. To adhere to industry regulations, CRMs should offer robust data encryption, access controls, and compliance tools.

- Client Interaction and Communication Tools: Efficient communication channels within the CRM enable better client interaction. Features like integrated email, calendars, and in-app messaging are crucial for maintaining strong client relationships.

- Automation and Task Management: The CRM should automate repetitive tasks for advisors to increase productivity. Automatic reminders, alerts, and task assignments help keep client management and follow-ups on track.

- Reporting and Analytics: Detailed reports and analytics empower advisors to make data-driven decisions. The CRM should offer custom report generation and real-time analytics to monitor the sales pipeline and client interactions.

Integrations with other financial tools, document management for easy storage and retrieval of client agreements, and a user-friendly experience are additional features that bolster the effectiveness of a CRM for financial advisors. Each of these functionalities plays a vital role in maximizing the efficiency and effectiveness of a financial advisor’s practice.

Top Recommendations

monday.com is a collaborative operating system that simplifies task management, project tracking, and team communication.

Act! is a popular CRM software designed to help small & medium-sized businesses manage contacts and marketing efforts effectively.

Best CRM Software for Financial Advisors

Selecting the right CRM software for financial advisors is crucial as it provides an integrated platform for managing client interactions, streamlines workflows, and facilitates effective marketing strategies—all essential for maintaining profitability and trust in the dynamic field of wealth management.

Best CRM Software for Financial Advisors (At a Glance)

| Software | Focus Area | Key Features | Best For |

|---|---|---|---|

| Salesforce Financial Services Cloud | Financial Services Industry | Customization, Advanced Analytics, Integration Capabilities | Large advisory firms seeking scalability and integration |

| Redtail Technology | Client Management | Ease of use, Automation, Robust client management | Financial advisors needing strong client management tools |

| Wealthbox | User Experience | User-friendly interface, Collaboration tools, Seamless integrations | Advisors prioritizing ease of use and collaboration |

| AdvisorEngine | Digital Wealth Management | CRM platform, Digital advice solutions, Operations streamlining | Firms integrating digital wealth management with CRM |

| eMoney Advisor | Financial Planning | Financial planning tools, Client lifecycle management | Financial advisors using comprehensive planning tools |

| Zoho CRM | Customizability | Customizable, Scalable, Automation, Analytics | Advisors seeking a customizable and scalable CRM solution |

| Microsoft Dynamics 365 | Scalability & Integration | Customization, Integration with Microsoft products, Advanced features | Firms looking for advanced customization and integration |

| HubSpot CRM | Inbound Marketing | Ease of use, Free CRM offering, Inbound marketing tools | Financial advisors focusing on inbound marketing strategies |

| Maximizer CRM | Client & Practice Management | Client management, Sales & marketing automation, Business productivity | Advisors needing robust customization and practice management |

| SmartOffice by Ebix | Insurance & Financial Services | Practice management, Productivity, Client relationship management | Insurance and financial services professionals |

| XLR8 | Salesforce Integration | Built on Salesforce, Industry-specific functionalities | Advisors looking for Salesforce with financial advisory customization |

| Insightly | Project Management & CRM | Lead management, Project tracking, Integration capabilities | Financial advisors managing client projects alongside CRM |

| Tamarac by Envestnet | Independent Advisors | Comprehensive software suite, CRM functionalities | Independent advisors seeking a comprehensive platform |

| Pipedrive | Sales Pipeline Management | Intuitive interface, Activity reminders, Customizable pipelines | Advisors focusing on sales pipeline management |

1. Salesforce Financial Services Cloud

Key Features:

- In-depth financial data analysis

- Extensive integration options with third-party applications

- Strong focus on data security and compliance

Rating: 4.5/5

Pros:

- Comprehensive AI-driven insights

- Robust data security features

- Highly scalable for growing financial practices

Cons:

- Steep learning curve for new users

- Higher cost compared to some competitors

- Can be complex to customize initially

Pricing: Starting at $150/user/month

Salesforce Financial Services Cloud is specifically designed for the financial services industry, bringing the power of Salesforce’s advanced CRM capabilities with a focus on wealth management, banking, insurance, and mortgage services.

It offers unparalleled customization and integration capabilities, making it a top choice for large advisory firms that need a scalable and flexible platform.

Its extensive ecosystem allows for the integration of numerous third-party applications, enhancing its functionality and adaptability to specific business needs.

Verdict: Salesforce Financial Services Cloud is renowned for its extensive features that cater to all scales of financial advisory firms, enhancing their productivity and client trust.

Check out Salesforce Financial Services Cloud here!

2. Redtail Technology

Key Features:

- Intuitive interface for improved user experience

- Automated workflows for efficient client management

- Comprehensive contact and activity tracking

Rating: 4.3/5

Pros:

- User-friendly platform with easy navigation

- Strong automation capabilities

- Robust integration with financial planning tools

Cons:

- Limited customization options

- Reporting features might be lacking for larger firms

- Some users may find the search functionality less intuitive

Pricing: $99/month for up to 15 users

Redtail Technology is widely acclaimed for its focus on client management and automation, offering a suite of tools that facilitate efficient client tracking, calendar management, and communication.

Its ease of use and robust feature set make it ideal for financial advisors who need a straightforward yet powerful CRM to manage their client interactions and daily activities.

Redtail’s focus on the financial advisory sector ensures that its tools are tailored to the unique requirements of advisors, including compliance support and integrations with leading financial planning and portfolio management software.

Verdict: Redtail Technology stands out for its exceptional user interface and client management automation, making it a favorite among advisory firms focused on efficiency and ease of use.

Check out Redtail Technology here!

3. Wealthbox

Key Features:

- Simple, intuitive design that requires minimal training

- Social collaboration tools for team interaction

- Integrated workflows and reporting features

Rating: 4.2/5

Pros:

- Strong user experience design

- Direct communication capabilities with clients

- Seamless integration with other financial tools

Cons:

- Limited customization for advanced users

- May lack advanced reporting features for larger firms

- Some features are only available in higher-tier plans

Pricing: Starting at $35/month per user

Wealthbox stands out for its simplicity and elegant user experience, providing financial advisors with an intuitive platform for managing client relationships, collaborations, and workflows.

Its ease of use does not sacrifice power; Wealthbox offers comprehensive CRM functionalities that help advisors stay organized, improve client communications, and enhance service delivery without a steep learning curve.

Verdict: Wealthbox offers a balance of function and form, excelling in collaboration and communication tools for financial advisors focused on maintaining strong lead management and client relationships.

4. AdvisorEngine

Key Features:

- Extensive financial planning and portfolio management features

- Modular approach for tailored advisor experience

- Integration with leading wealth management platforms

Rating: 4.1/5

Pros:

- Strong financial planning and reporting tools

- High level of customization available

- Seamless integrations with third-party tools

Cons:

- Can be overwhelming for small firms due to its robust nature

- The price may be prohibitive for solo practitioners

- The extensive feature set requires a learning curve

Pricing: Contact for pricing

AdvisorEngine provides a modern CRM platform integrated with digital wealth management technology, designed to streamline operations and enhance client engagement for financial advisors.

It offers customizable digital client onboarding, portfolio management, and interactive client portals, facilitating a high-tech, high-touch client experience.

AdvisorEngine’s integration with leading fintech solutions and robust automation tools allow advisors to deliver personalized advice efficiently and scale their practices effectively.

Verdict: AdvisorEngine is a versatile and customizable option for advisors seeking a platform that integrates advanced financial planning and wealth management tools in one place.

5. eMoney Advisor

Key Features:

- Comprehensive financial planning tools

- Interactive client portals

- Robust data encryption

Rating: 4.2/5

Pros:

- Integrated financial planning capabilities

- High data security standards

- Intuitive client engagement tools

Cons:

- Higher learning curve for new users

- May be cost-prohibitive for some firms

- Limited customizability in certain areas

Pricing: Typically starts at $4,000 annually for a basic plan

Primarily known for its financial planning software, eMoney Advisor also includes CRM functionalities tailored for financial advisors. It emphasizes holistic financial management, offering tools for budgeting, investment strategy, estate planning, and more, integrated with client management features.

eMoney’s strength lies in its ability to provide a comprehensive view of a client’s financial life, facilitating more informed advice and personalized service.

Its client portal enhances advisor-client interaction by enabling secure communications and real-time financial overview.

Verdict: eMoney Advisor stands out for its advanced financial planning features and robust security measures, making it a trusted choice for advisors managing complex portfolios.

Check out eMoney Advisor here!

6. Zoho CRM

Key Features:

- Multichannel communication support

- Artificial intelligence capabilities

- Extensive customization options

Rating: 4.0/5

Pros:

- Affordable pricing for small firms

- User-friendly interface

- Strong integration capabilities

Cons:

- Occasional complexities with advanced features

- Limited features on the basic plan

- Additional costs for premium integrations

Pricing: Starts at approximately $14 per user per month for the Standard edition

Zoho CRM offers a customizable and scalable solution suitable for financial advisors of all sizes. It features automation of sales processes, multi-channel communication, and advanced analytics and reporting tools.

Zoho’s flexibility allows advisors to tailor the CRM to their specific workflows and client management needs, with extensive integrations available to connect with other financial tools.

Its AI-powered assistant, Zia, provides sales predictions, lead scoring, and smart alerts, enhancing advisors’ ability to prioritize and engage clients effectively.

Verdict: Zoho CRM is favored for its value, offering a scalable and customizable CRM solution suitable for financial advisors keen on personalizing client interaction and automating workflows.

7. Microsoft Dynamics 365

Key Features:

- Seamless integration with Microsoft products

- Advanced analytics and reporting tools

- High scalability for growing businesses

Rating: 4.1/5

Pros:

- Deep integration with existing Microsoft services

- Strong automation and customization capabilities

- Comprehensive sales and customer service modules

Cons:

- Can be complex without proper training

- Higher cost compared to other CRMs

- Potentially lengthy implementation process

Pricing: Dynamics 365 Sales pricing starts at around $65 per user per month

Microsoft Dynamics 365 delivers a highly customizable CRM platform with seamless integration with the Microsoft ecosystem, including Office 365, Teams, and more.

This integration is particularly beneficial for firms already embedded in Microsoft’s infrastructure, offering a unified experience that boosts productivity and collaboration.

Dynamics 365’s advanced analytics, AI capabilities, and modular approach allow financial advisors to build a CRM solution that fits their specific needs while leveraging Microsoft’s cloud security and compliance features.

Verdict: Microsoft Dynamics 365 is renowned for its robust analytical tools and exceptional ability to integrate with the Microsoft suite, catering to firms that require a high level of sophistication and detail in client management.

Check out Microsoft Dynamics 365 here!

8. HubSpot CRM

Key Features:

- User-friendly interface

- Free core CRM offerings

- Comprehensive contact management

Rating: 4.5/5

Pros:

- No cost for basic CRM features

- Intuitive design and ease of use

- Extensive training and support resources

Cons:

- Advanced features require paid plans

- Some limitations in reporting capabilities on the free version

- Integrations with other software may require premium access

Pricing: Free for core CRM features; paid plans start at $50 per month for added functionalities

HubSpot CRM is renowned for its user-friendly design and robust inbound marketing tools, making it an attractive choice for financial advisors focusing on building strong client relationships through content marketing, social media, and email marketing.

Its free CRM offering provides a comprehensive set of features to manage contacts, deals, and activities, with scalability options to add more advanced sales, marketing, and service features as the business grows.

HubSpot’s emphasis on inbound strategies helps advisors attract, engage, and delight clients, fostering long-term relationships.

Verdict: HubSpot CRM is a popular choice for its ease of use and free access to essential CRM features, ideal for independent advisors and small firms seeking cost-effective solutions.

9. Maximizer CRM

Key Features:

- Specific edition tailored for financial advisors

- Robust client and contact management

- Comprehensive reporting and analytics

Rating: 3.8/5

Pros:

- Industry-specific features for financial services

- Streamlined client account documentation

- Strong client relationship management tools

Cons:

- The interface may feel dated to some users

- Limited options for third-party integrations

- Less competitive pricing for smaller firms

Pricing: Wealth Manager edition pricing provided upon request

Maximizer CRM focuses on client and practice management, offering a suite of tools designed to enhance client engagement, automate sales and marketing processes, and improve business productivity.

Its customizability and industry-specific solutions make it a strong candidate for financial advisors needing a tailored approach to CRM, with features supporting client segmentation, compliance tracking, and performance analysis.

Maximizer’s cloud-based platform facilitates access to client data and tools from anywhere, enhancing flexibility and responsiveness for advisors.

Verdict: Maximizer CRM is specifically tailored for wealth management, providing features that directly cater to the needs of financial advisors looking to manage client information and portfolios effectively.

10. SmartOffice by Ebix

Key Features:

- Customizable dashboard and reporting

- Workflow automation tools

- Comprehensive client management options

Rating: 3.9/5

Pros:

- Highly customizable interface

- Strong focus on financial services industry

- Efficient client data aggregation

Cons:

- Steeper learning curve

- Higher price point for smaller firms

- Additional costs for integrations

Pricing: Custom pricing based on the firm’s size and needs

SmartOffice caters to insurance and financial services professionals, providing solutions for practice management, client relationship management, and productivity enhancement. Its comprehensive feature set supports advisors in managing client data, tracking business performance, and automating workflows.

SmartOffice’s industry focus ensures that its tools are compliant with financial regulations and are tailored to the specific needs of insurance agents, financial advisors, and broker-dealers.

Verdict: SmartOffice by Ebix is designed for financial services professionals who require a customizable CRM with strong workflow and task automation capabilities.

Check out SmartOffice by Ebix here!

11. XLR8

Key Features:

- Salesforce-based customization

- Seamless integration with financial planning tools

- Strong focus on wealth management

Rating: 4.0/5

Pros:

- Leverages Salesforce’s robust platform

- Tailored to the needs of wealth managers

- Excellent integration with financial planning software

Cons:

- Requires familiarity with the Salesforce platform

- Can be costly for additional customization

- The complexity of features may be overwhelming for some

Pricing: Pricing based on the Salesforce subscription plus additional costs for XLR8-specific features

XLR8 is a CRM solution built on the Salesforce platform, specifically designed for financial advisors. It leverages the power and flexibility of Salesforce while adding custom features and workflows tailored to the wealth management industry.

XLR8’s integration with Salesforce enables advisors to access advanced analytics, extensive customization options, and a vast ecosystem of apps through the Salesforce AppExchange, all while benefiting from CRM functionalities specifically designed for financial advisory practices.

Verdict: XLR8 benefits from the versatility of Salesforce and offers a specialized experience for financial advisors seeking a comprehensive CRM for wealth management.

12. Insightly

Key Features:

- Ease of use and simple user interface

- Powerful project management tools

- Strong pipeline management capabilities

Rating: 3.7/5

Pros:

- Affordable for small to mid-sized businesses

- Intuitive design, quick setup

- Good customer support with accessible resources

Cons:

- Limited customizability in comparison to bigger CRMs

- Basic reporting features in lower-tier plans

- Some users may require additional integrations at extra cost

Pricing: Starts at $29 per user per month for the Plus plan

Insightly offers CRM and project management capabilities in a single platform, making it an excellent choice for financial advisors who manage complex client projects alongside their sales and marketing activities.

Its lead management, project tracking, and delivery capabilities ensure that advisors can keep track of client engagements from initial contact through to project completion.

Insightly’s integration with popular apps and tools enhances its utility, providing advisors with a comprehensive platform to manage client relationships and projects efficiently.

Verdict: Insightly is appreciated for its project management tools and simplicity, fitting for financial advisors focusing on straightforward client and pipeline management.

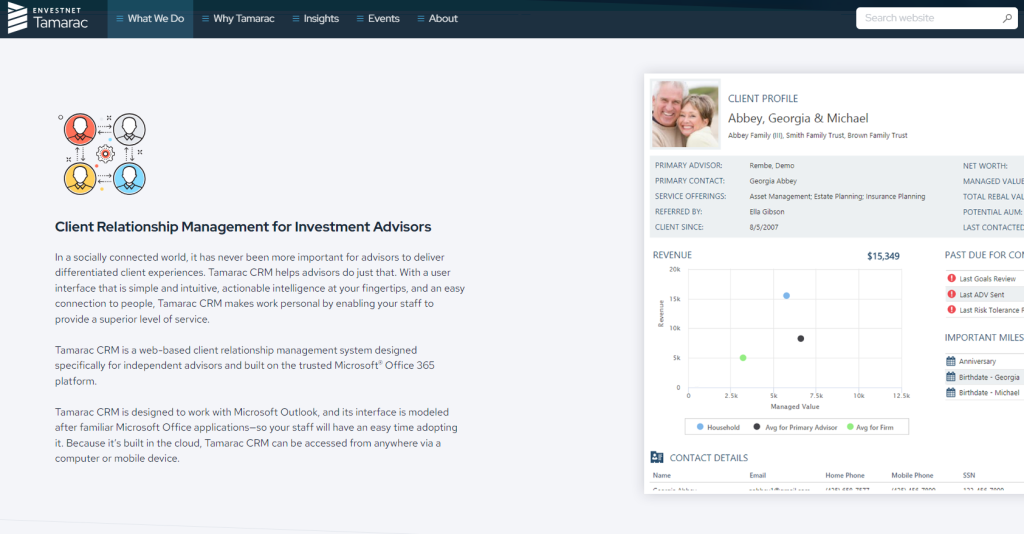

13. Tamarac by Envestnet

Key Features:

- Comprehensive portfolio and client account management

- Customizable reporting tools

- Interactive client portal

Rating: 4.3/5

Pros:

- Deeply focused on asset management and wealth advisory

- High level of custom report generation

- Enhances client engagement with interactive tools

Cons:

- More expensive for smaller practices

- Complexity requires time to master

- Aimed at larger firms with more extensive needs

Pricing: Pricing provided upon request, often based on assets under management

Tamarac provides a comprehensive suite of software solutions designed for independent advisors, including CRM functionalities that support enhanced client management and advisory services.

Its platform integrates portfolio management, reporting, trading, rebalancing, and client portal capabilities, offering advisors a holistic approach to managing client investments and interactions.

Tamarac’s emphasis on automation and efficiency helps advisors streamline operations, improve client service, and focus on growth.

Verdict: Tamarac by Envestnet provides an all-in-one platform that excels in asset management and reporting, particularly suited for larger advisory firms that need a comprehensive suite of tools.

Check out Tamarac by Envestnet here!

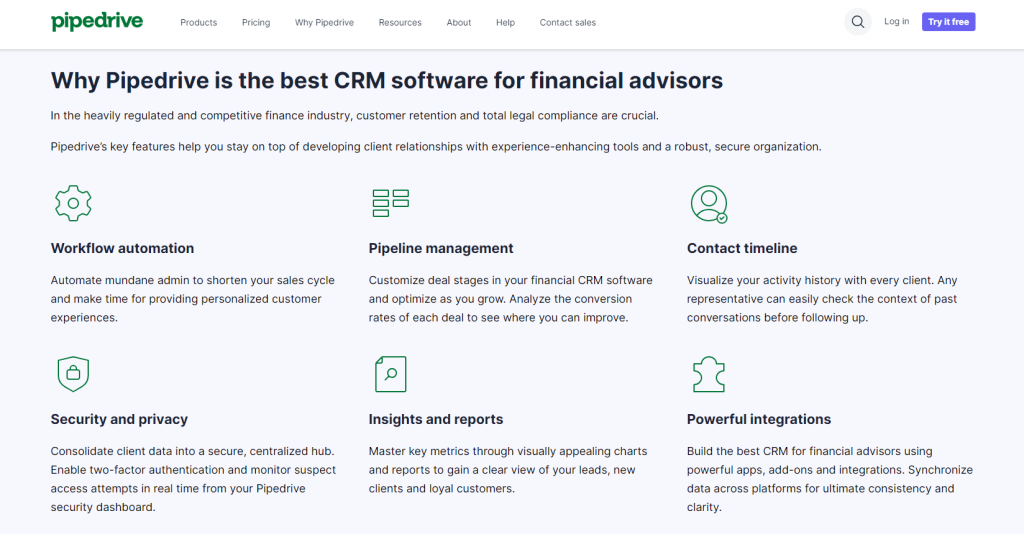

14. Pipedrive

Key Features:

- User-centric pipeline management

- Strong sales automation and tracking

- Easy-to-use interface

Rating: 4.2/5

Pros:

- Intuitive and visually appealing design

- Customizable pipelines and reporting

- Affordable for small to medium-sized firms

Cons:

- Limited functionality for complex wealth management needs

- Basic tier lacks some advanced analytics tools

- May not scale as well for larger enterprises

Pricing: Plans start at $18 per user per month for the Essential tier

Pipedrive is designed with a focus on sales pipeline management, offering financial advisors an intuitive platform to track and manage their sales processes.

Its visual interface, customizable pipelines, and automation of repetitive tasks help advisors stay organized and focused on client engagement.

Pipedrive’s emphasis on activity-based selling and its capability to integrate with a wide range of financial planning and communication tools make it a valuable asset for advisors looking to enhance their sales strategies and client communication efforts.

Verdict: Pipedrive excels in its simplicity and effectiveness in managing sales pipelines, suitable for financial advisors who prioritize lead management and sales tracking.

FAQs

Are there any robust free CRM options available that are suitable for financial advisors?

Free CRM options for financial advisors do exist, but they may offer limited functionality compared to paid versions. One may find basic features useful for client relationship management, but for more comprehensive services, including advanced security or more extensive client management tools, they might need to explore paid CRM solutions.

How Do CRMs for Financial Services Differ from Traditional CRMs Used in Other Industries?

CRMs for financial services are tailored to address specific regulatory and compliance needs of the industry. They often include features for managing sensitive financial data, integrating with industry-specific software, and supporting complex client management structures that are not typically required in CRMs used in other industries. This specialization ensures that financial advisors can effectively track client interactions, manage assets, and maintain compliance with financial regulations.