Before we dive into the differences, a quick 101 on these models:

Employer of Record (EOR) acts as the legal employer for a company’s workforce, assuming complete responsibility for formal employment tasks. This entity is particularly beneficial for companies looking to hire employees internationally without establishing a local legal entity. An EOR simplifies the hiring process in foreign countries, managing the legal compliance, payroll, taxes, and employment risks associated with the employee.

In contrast, Professional Employer Organization (PEO) enters a co-employment relationship with a company to manage multiple aspects of the human resources functions. This includes payroll, benefits administration, and compliance with employment laws. However, the original company retains its status as the legal employer. PEO services are typically used within the locations where the company has an established legal entity, catering to an existing local workforce.

What we cover

Key Differences

Employer of Record (EOR):

- An EOR becomes the legal employer for a company’s workforce.

- It handles employee relations, tax withholdings, compliance with employment laws, and benefits administration.

- EOR services are typically leveraged when a company wants to employ staff in a new country without setting up a local entity.

Professional Employment Organization (PEO):

- PEO enters into a co-employment arrangement with businesses, sharing employer responsibilities.

- Primarily offers HR services, payroll, and workers’ compensation for a company’s existing workforce.

- PEOs tend to cater to the needs of small and medium-sized businesses with local operations.

| EOR | PEO | |

|---|---|---|

| Legalities | Acts as the legal employer on behalf of another company. | Shares legal employer responsibilities in a co-employment setup. |

| Scope | Suitable for global employee management. | Generally for local workforce within the business’s home country. |

| Operations | Used often to bypass the need for a local business entity. | Supports existing HR structures without the need to form new entities. |

Advantages and Disadvantages

EOR advantages:

- They provide businesses the ability to quickly onboard staff in new markets without establishing local branches or subsidiaries.

- EORs bear full responsibility for compliance with local employment laws, decreasing the legal risks for companies.

EOR disadvantages:

- They might be more costly for businesses that only require minimal employment support outside of their home country.

PEO advantages:

- By offering a range of HR services, PEOs can alleviate the administrative burden on HR professionals in a company.

- The co-employment model allows companies to retain more control over their employees while still outsourcing certain HR tasks.

PEO disadvantages:

- Since liabilities are shared, businesses may still be exposed to some legal and financial risks.

- PEOs are not always the best fit for managing international employees due to limitations in global employment law expertise.

Decisions regarding whether to use an EOR or PEO service must consider the company’s size, the extent of its international operations, and the specific HR needs. The relationship dynamics with employees and the priorities for operational control also influence the choice between EOR and PEO services.

Operational Framework of EOR and PEO

The operational frameworks of an Employer of Record (EOR) and a Professional Employment Organization (PEO) define their distinct legal structures, employment responsibilities, and the handling of HR functions. Understanding these frameworks is crucial for businesses to make informed decisions.

Legal Structure and Employer Responsibilities

An Employer of Record (EOR) assumes all legal responsibilities for their clients’ employees, including adherence to employment laws, payroll, taxes, and visa applications. They employ workers on behalf of another company and bear the full legal responsibility for those employees. In contrast, Professional Employment Organizations (PEOs) enter into a co-employment relationship, where they share employer responsibilities with the client company. This model allows the client company to outsource HR tasks while retaining day-to-day control over employees.

Co-Employment Model in PEO

The co-employment model is a distinctive feature of PEOs. In this arrangement, both the PEO and the client company share certain employer liabilities:

- PEO: Manages employee-related tasks such as payroll processing, benefits administration, and compliance with labor laws.

- Client Company: Retains control over business operations and management of the workforce.

This shared structure enables companies to outsource complicated HR functions while maintaining essential operational control over their employees.

HR Functions Managed by EOR and PEO

Both EORs and PEOs manage a range of HR functions, but to different extents. Generally, an EOR will handle the following:

- Hiring and onboarding

- Employee payroll

- Compliance with employment laws

- Work visa sponsorship, if applicable

PEOs, while also managing HR tasks, generally provide a more collaborative approach to HR services:

- Human resources management

- Benefits administration

- Risk management

- Workers’ compensation

In both cases, companies can delegate HR tasks to reduce the administrative burden and focus on their core operations.

Human Resources and Compliance

Professional Employer Organizations (PEOs) and Employers of Record (EORs) both play distinct roles in human resources and compliance. The differences in these services are crucial for companies to understand in order to align their HR solutions with business needs.

Payroll and Tax Management

PEOs: They co-employ workers and share the responsibility of payroll processing, including wage distribution and withholding taxes. PEOs assist companies by ensuring adherence to tax laws and regulations related to employee pay.

EORs: In contrast, an EOR becomes the legal employer for tax purposes and completely manages payroll, taking on the responsibilities for accurate tax filing and reporting, in both domestic and international contexts.

Benefits Administration and Insurance

PEOs: They typically provide employees with access to a wide range of benefit programs which may include health, dental, and vision insurance. By pooling employees from multiple companies, PEOs can often negotiate better rates for these insurance benefits.

EORs: While they also manage the administration of benefits, EORs are especially useful for companies looking to offer benefits to employees in regions where the company may not have an established presence, ensuring legal compliance with local benefit laws.

Compliance with Employment Laws

PEOs: These organizations share legal compliance responsibilities with the client company. They stay abreast of changes in employment law and help ensure that policies and practices comply with both federal and state regulations.

EORs: They assume full legal responsibility for employment compliance, which includes adherence to workplace safety, workers’ compensation requirements, and other employment-related legal mandates. This is particularly valuable for companies that operate internationally and must navigate varying compliance landscapes.

International and Local Operations

When managing a global workforce, companies must choose the right structure to handle international and local legal compliance and operational flexibility. They should consider how international talent can be employed and managed effectively, while also adhering to local labor laws.

Handling Remote and International Workforce

Employers of Record (EORs) enable businesses to hire international talent without the necessity of establishing a legal entity in the employee’s country. EORs act as the legal employer for the remote worker, taking responsibility for HR functions, payroll, and tax compliance. This arrangement provides flexibility for companies to enter international markets quickly and scale their global workforce according to business needs.

- Physical Presence: Not required for the company employing through an EOR.

- Operational Flexibility: EORs provide the infrastructure to manage a remote and global workforce effectively.

Adherence to Local Labor Laws

On the other hand, a Professional Employer Organization (PEO) typically requires a company to have an established registered business entity in the local area. PEOs co-employ local staff, sharing the responsibility for employment and compliance.

- Local Labor Laws: PEOs ensure compliance with the intricate details of local labor regulations.

- Registered Business Entity: Companies using a PEO service are likely to have a presence or are planning to set a firm footprint in the local market.

Both EORs and PEOs offer significant advantages when it comes to managing employees across varied jurisdictions, but their scopes and applications are distinct, particularly regarding the need for a physical presence and flexibility in international and local operations.

Strategic Management and Growth

Risk Management and Liability

In terms of risk management and liabilities, partnering with a PEO involves shared legal liability, often referred to as co-employment. Such an arrangement can help mitigate the employer’s inherent risks by distributing them with the PEO. On the other hand, EORs assume full employer responsibility, which greatly reduces the legal and compliance risks that the client company would otherwise face.

EORs:

- Significantly reduce client liability.

- Provide comprehensive risk management services.

PEOs:

- Share liabilities under a co-employment model.

- Assist with maintaining compliance for domestic workforce management.

Financial and Administrative Aspects

The financial and administrative aspects of EORs and PEOs reveal distinct cost implications and management of employee-related functions. The choice between an EOR and a PEO can significantly impact a company’s financial strategies and how they administer benefits and compensation to their workforce.

Cost Structures and Fees

Employer of Record (EOR) agencies typically charge a flat fee per employee or a percentage of each employee’s salary. These fees encompass payroll processing, tax filing, and legal compliance, which allows businesses to forecast expenses without significant variation.

On the other hand, Professional Employment Organization (PEO) services are often billed as a percentage of the overall payroll or a per-employee fee. PEO partnerships might also involve various premiums for extended services, such as workers’ compensation and employee benefits administration. Due to economies of scale, larger organizations can sometimes negotiate lower rates with PEOs.

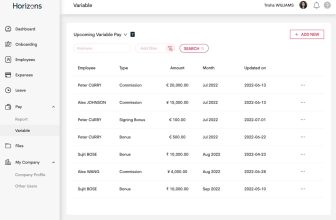

Employee Benefits and Compensation

When it comes to employee benefits administration, a PEO can offer a more comprehensive package by leveraging the collective bargaining power of a larger employee pool to negotiate benefits, which can include health insurance, retirement plans, and other perks. PEOs also handle workers’ compensation by including it in their service offerings.

In contrast, an EOR may limit their support to mandatory benefits administration, with client companies retaining the responsibility of arranging additional perks. Additionally, an EOR assumes liability in employee affairs, ensuring compliance with employment laws, thereby mitigating risks for the client company.

In both models, the company retains control over employee compensation, including salaries and bonuses, whereas the administrative partner—either a PEO or EOR—handles the complexities of processing and distribution.

Employee Lifecycle and Engagement

In the context of EOR and PEO, their roles distinctly influence the employee lifecycle from hiring to termination. Each model offers a different scope of services that can impact day-to-day operations and HR responsibilities, particularly concerning remote work.

Hiring and Onboarding Processes

An Employer of Record (EOR) streamlines the hiring process, especially for remote teams, by handling all legal and HR responsibilities. In regions where a company may not have a legal entity, an EOR can legally hire employees on the company’s behalf. The onboarding process is similarly managed, ensuring that employees are integrated into the company despite geographical boundaries.

- Hiring: An EOR manages job postings, interviews, and employment contracts.

- Onboarding: They facilitate introductions, training schedules, and necessary equipment provisions for remote work setups.

A Professional Employer Organization (PEO), on the other hand, works through co-employment. Businesses retain more control over hiring decisions but share employee management responsibilities with the PEO.

- Hiring: PEOs often assist with recruitment and provide support for the company’s hiring process.

- Onboarding: They typically share the responsibility of employee integration with the business, supplying resources and support.

Termination and Turnover Management

With termination and employee turnover, both EOR and PEO provide critical support, although their involvement varies. An EOR fully manages the termination process in compliance with local laws, which is particularly important for companies without an in-country HR presence. This reduces the risks associated with employee turnover, including the legal challenges of ending employment across different jurisdictions.

A PEO provides guidance and support during termination but requires the company to be more involved in the process. They help navigate HR responsibilities such as:

- Severance packages

- Legal requirements

- Exit interviews

Both models aim to mitigate turnover by supporting consistent and fair HR practices throughout the employee’s tenure. However, direct engagement and the extent of responsibility differ, with EORs taking a more comprehensive role in managing these aspects.

Legal and Contractual Considerations

When contemplating the engagement of a Professional Employer Organization (PEO) or an Employer of Record (EOR), one must carefully evaluate their distinctive legal and contractual obligations. These affect compliance risk and regulatory requirements, particularly in the context of employment contracts and insurance coverage.

Employment Contracts and Legal Advice

An EOR assumes the role of the legal employer for the client company’s workforce. This arrangement involves the EOR managing employment contracts, ensuring compliance with labor laws, and providing legal advice as necessary. When a business employs an EOR service, they transfer significant legal and compliance risk to the EOR, who then becomes responsible for regulatory compliance within the jurisdiction where the employees reside.

- Responsibilities under EOR:

- Contract drafting and management

- Compliance with labor laws

- Provision of legal advice

A PEO, on the other hand, enters into a co-employment arrangement with the client company. Under this model, the client company and the PEO share legal responsibilities related to employees, with the PEO typically advising on employment contracts and supporting regulatory compliance.

- Shared responsibilities under PEO:

- Co-drafting of employment contracts

- Shared legal liabilities

- Assistance with regulatory compliance

Insurance Plans and Workers’ Compensation Coverage

Both PEOs and EORs provide insurance plans and manage workers’ compensation coverage for employees. However, their roles differ significantly in terms of the administration of these programs.

- Insurance under EOR:

- The EOR fully manages workers’ compensation plans.

- It provides insurance coverage directly to the employees.

Under the PEO model, insurance plans and workers’ compensation are offered through the co-employment relationship, with risk typically being shared between the PEO and the client company.

- Insurance under PEO:

- Joint management of workers’ compensation plans with the client company.

- Insurance offerings may be part of the PEO’s master policies.

In summary, businesses must consider the differences in legal and insurance liabilities between PEOs and EORs and how these affect their organizational risk and compliance posture.

FAQs

How do PEO services differ from EOR services in their operation?

PEOs typically form a co-employment arrangement, where they share HR tasks and liabilities with the client company. EOR services, on the other hand, fully employ workers on behalf of the client company and manage all employment-related tasks and compliance.

Can an organization be both a PEO and an EOR, and what distinguishes their roles?

An organization can offer both PEO and EOR services; however, each service has a distinct role. A PEO acts as a co-employer, sharing employment responsibilities, while an EOR becomes the legal employer and entirely manages employment tasks without clients entering a co-employment agreement.

What are the legal liabilities for companies using PEO versus those using EOR?

Companies using a PEO share the legal liabilities related to employment, such as compliance with labor laws and tax regulations. Contrastingly, an EOR assumes full legal liability for employment-related matters on behalf of the client company.

How do the HR responsibilities managed by a PEO compare with those handled by an EOR?

A PEO shares HR responsibilities with the client company and typically handles tasks like payroll administration, benefits, and compliance. EORs comprehensively manage HR responsibilities, including hiring, onboarding, and managing global workforce compliance without co-employment.

In what ways do the services provided by global EORs differ from those offered by PEOs?

Global EOR services focus on enabling companies to employ individuals internationally by handling all local employment laws, tax, and payroll issues. PEOs, conversely, usually support existing local workforces with broader HR responsibilities within the country of the PEO’s operation.

What are the key variations in the co-employment model used by PEOs as opposed to the full-employment model of EORs?

The PEO co-employment model involves sharing control and responsibilities between the PEO and the client company. The EOR model constitutes full employment by the EOR, meaning the EOR is the legal employer and manages all regulatory, tax, and employment risks.