An EOR allows companies to seamlessly hire employees, especially when expanding internationally, without establishing a legal entity in the host country.

These services assume a wide range of employment-related responsibilities, such as:

- Legal compliance: Adhering to local labor laws and regulations.

- Payroll administration: Managing accurate and timely payment of salaries.

- Tax filing: Withholding and filing taxes in accordance with local requirements.

- Benefits administration: Offering and managing employee benefits programs.

Choosing an EOR can be particularly beneficial for companies who need to employ workers in a country where they do not have a physical presence or legal entity. The EOR’s expertise in local employment law protects companies from legal exposure and potential fines arising from non-compliance.

It is important for companies considering an EOR to perform due diligence in selecting a reliable provider that fits their business needs.

What we cover

Benefits

Employers of Record (EOR) offer comprehensive solutions for businesses looking to navigate the complex landscape of global employment. Employers reap the benefit of EOR services to ensure compliance with local laws, streamline payroll, manage HR tasks, and access global talent efficiently.

1) Compliance Assurance

Employers of Record shoulder the responsibility of compliance with local employment laws, mitigating the risks associated with international labor and tax regulations. This includes staying abreast of changes and implementing necessary updates to employment practices, thereby protecting client companies from potential legal issues.

2) Streamlined Payroll Processing

EORs provide centralized and streamlined payroll processing services, handling the calculation, withholding, and disbursement of employee salaries. This ensures a seamless operation, despite varying international tax laws, resulting in timely and accurate payroll execution.

3) Efficient HR Tasks Management

EOR services are designed to alleviate the burden of HR tasks. By managing day-to-day HR responsibilities, from employee onboarding to benefits administration, these services allow companies to focus on core business activities, with the peace of mind that HR operations are being handled expertly.

4) Strategic Talent Acquisition

The ability to tap into a global talent pool is a significant benefit of EOR services. They empower businesses to legally recruit and retain employees from across the world without setting up a local entity, thus providing a strategic advantage in talent acquisition and contributing to diversity and innovation in the workforce.

Global Workforce Management

Employer of Record (EOR) services enable companies to efficiently manage a global workforce by handling the complexities of hiring international talent, ensuring legal compliance, and structuring benefits and compensation.

Hiring International Talent

An Employer of Record significantly simplifies the process of recruiting global talent. Through an EOR, companies can tap into a worldwide pool of professionals without establishing legal entities in each country. The EOR facilitates hiring by managing international worker contracts, thus allowing businesses to focus on selecting the right candidates for their needs without getting entangled in the nuances of local employment laws.

Legal Compliance Across Borders

Ensuring legal compliance when managing a global workforce is a critical aspect of an EOR’s services. As each country has its unique employment regulations, an EOR must be well-versed in these differences to navigate them successfully. This includes traditional tasks like contract creation and maintenance to be harmonious with local employment laws, and extends to more complex responsibilities such as handling immigration and work permits, tax filing, and severance laws, ensuring that both the employer and the employees are safeguarded against legal pitfalls.

Benefits and Compensation Structures

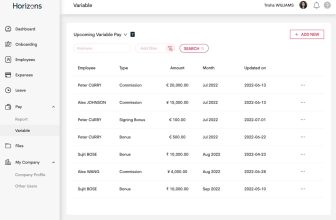

A comprehensive benefits and compensation package is key to attracting and retaining international talent. An EOR manages these structures, ensuring that they meet country-specific standards and expectations, and align with the company’s overall remuneration framework. An Employer of Record ensures that salary payments are processed through local bank accounts, and employee expenses are managed and approved in compliance with local tax guidelines. The EOR also tracks compensation and benefits administration, thus allowing seamless operation of a diverse and geographically dispersed workforce.

Key Operational Aspects

Employer of Record (EOR) services facilitate crucial HR processes, such as onboarding new hires and managing employment contracts. They ensure the administration of employee benefits complies with local laws. These operational facets are vital for the smooth functioning and legal compliance of global workforces.

Onboarding and Offboarding Protocols

Employer of Record services streamline the onboarding process, ensuring new hires are integrated into the company efficiently and in compliance with legal requirements. This typically includes verifying worker eligibility, completing necessary documentation, and setting up payroll. Offboarding, conversely, is managed to ensure a smooth transition for both the employee and the company, handling tasks such as revocation of company access and ensuring final paycheck delivery.

- Onboarding: Documentation, Eligibility Checks, Payroll Setup

- Offboarding: Access Revocation, Final Paycheck Disbursements

Managing Contracts and Employment Terms

EOR services handle employment contracts with precision, maintaining meticulous records and ensuring they abide by local employment laws. Each contract delineates the terms of employment, including job responsibilities, salary, and duration of employment. These contracts are crafted and managed by the EOR to ensure clear communication of expectations and legal protection for both the employer and the employee.

- Contract Creation

- Record Maintenance

- Compliance with Local Laws

Administering Employee Benefits

Benefits administration is a complex aspect that EOR services cover with expertise. They navigate the intricacies of local regulations to provide employees with the obligatory benefits, which may encompass health insurance, retirement plans, and paid time off, among others. The EOR ensures these benefits are managed efficiently, fostering a positive employee experience and adherence to legal standards.

- Health Insurance

- Retirement Plans

- Paid Time Off Management

Evaluating Costs and Pricing Models

When considering engaging an Employer of Record (EOR), it’s critical for businesses to understand the different pricing models, conduct a cost-benefit analysis, and budget accordingly.

Understanding EOR Pricing

Evaluating the cost of EOR services begins with a clear understanding of the pricing models available. The most common models include:

- Pay-Per-Employee: A variable cost model, often preferred for its scalability, where the EOR fees are determined by the number of employees.

- Fixed Pricing: A consistent monthly fee regardless of the number of employees, allowing for easy budget forecasting.

- Custom Pricing: Tailored to specific business needs, often incorporating elements of both fixed and variable pricing to suit unique scenarios.

Each pricing model can be influenced by factors such as geographic complexity, industry-specific considerations, and workforce size.

Cost-Benefit Analysis

Businesses should weigh the cost of EOR services against the potential benefits, such as:

- Compliance with local labor laws: Reducing the risk of legal penalties.

- Streamlined onboarding: Simplifying the process of hiring international employees.

A detailed analysis may reveal cost savings through reduced legal and HR overhead, or through the strategic management of international payroll and taxes.

Budgeting for EOR Services

Companies need to allocate financial resources thoughtfully to cover the costs associated with an EOR partner. To budget effectively, one should consider:

- Anticipated growth trajectory of the company.

- The complexity of managing an international workforce.

Businesses should request detailed quotes from potential EOR partners, encompassing all service fees and potential variable costs, to ensure accurate budgeting and avoid unforeseen expenses.

Legal Considerations and Risks

When engaging an Employer of Record (EOR), organizations must navigate a complex landscape of legal considerations and potential risks. These range from adhering to local labor laws to managing immigration compliance and understanding termination liabilities.

Local Labor Law Compliance

Employer of Record services must operate within the framework of local labor laws, which vary significantly from country to country. Compliance with these laws is critical to avoid legal repercussions. They must ensure that:

- Minimum wage standards are met.

- Working hours, break times, and overtime pay comply with local regulations.

- Benefits and leave policies align with statutory requirements.

Failure to adhere can result in penalties, legal action, and reputational damage.

Immigration and Work Permits

EORs are responsible for navigating immigration laws to obtain the necessary work permits and visas for employees. This involves:

- Understanding the specific requirements and restrictions in each country.

- Maintaining up-to-date knowledge of changes to immigration regulations.

Inadequate oversight of immigration compliance can lead to fines and legal challenges, affecting the EOR and potentially the parent company.

Termination and Legal Liabilities

Handling the termination of employees is a delicate area due to differing laws and protections across jurisdictions. An EOR must:

- Respect local legal processes for termination.

- Maintain clear documentation to defend against wrongful termination claims.

Termination without proper adherence to local legal procedures can expose the EOR and the company to significant liabilities.

Best Practices for Partnering with EOR

When entering into a partnership for global expansion, businesses should be methodical in selecting an Employer of Record (EOR) with the right industry expertise. The EOR market offers solutions tailored to risk management and compliance, critical when hiring across varied legislative landscapes.

1. Due Diligence: Companies must thoroughly assess potential EOR partners. This includes evaluating their legal compliance, financial stability, and track record.

– Investigate credentials and certifications.

– Verify testimonials and case studies.

2. Comprehensive Service Evaluation:

– Identify services that align with the company’s expansion goals.

– Ensure the EOR offers robust payroll, tax, and HR support.

3. Risk Assessment:

EORs should facilitate risk management, mitigating liabilities related to employment laws and regulations.

– Inquire about their strategies for managing local employment laws.

– Review their processes for keeping abreast of legal changes.

4. Clear Communication:

Effective communication sets the foundation for a successful partnership. A reputable EOR will maintain open and transparent dialogue.

– They should provide easily accessible support and regular updates.

5. Scalability and Flexibility:

Choose an EOR that can adapt to the changing needs of your business. They should have the capacity to grow with your company.

– Check if they can handle variable employee volume.

– Consider if they offer a range of services that can be scaled.

6. Leveraging Expertise:

Collaborating with an EOR should bring valuable insights and industry expertise to the table. They can act as consultants regarding best practices in new markets.

– Utilize their knowledge to navigate global employment more effectively.

– Gain insights into local market trends and practices.

EOR Selection Checklist:

| Criteria | Details to Consider |

|---|---|

| Compliance | Legal standards, certifications |

| Services | Payroll, tax, HR support |

| Risk Management | Strategies, legal changes assessment |

| Communication | Support availability, updates |

| Scalability | Adjust to business growth, service range |

| Industry Expertise | Market insights, local employment best practices |

Selecting the right EOR is essential for mitigating risks during global expansion, ensuring compliance, and accessing industry-specific knowledge for smooth international operations.

Comparing EOR with PEO and Staffing Agencies

EOR and PEO both offer human resources services, but they do so in distinct ways. An EOR becomes the legal employer of their client’s employees, managing HR, payroll, and benefits. They typically do not engage in recruitment. In contrast, a PEO enters into a co-employment arrangement where they share certain employer responsibilities with the client company. Staffing agencies differ from both EORs and PEOs in that their primary service is to recruit, screen, and place employees in temporary or permanent positions for their clients.

Legal and Tax Implications

The EOR assumes full legal responsibility for employment matters, including tax compliance and adherence to local labor laws, which can be pivotal for companies employing overseas. A PEO shares some of these legal responsibilities through co-employment but does not assume them completely. Staffing agencies usually do not take on legal employer responsibilities; they simply find talent, while the client company remains the legal employer.

- EOR: Legal employer; responsible for tax and employment law compliance.

- PEO: Shares legal obligations with the client; co-employment model.

- Staffing Agency: Finds talent; client handles legal and tax responsibilities.

Scope of Responsibilities

Responsibilities for an EOR include managing employment contracts, maintaining tax compliance, and handling benefits administration. A PEO will also manage these tasks but shares the responsibility with the client, depending on their agreement. Staffing agencies typically have a narrower scope, focusing mainly on the hiring process, and leave the contract management and compliance to the client.

- EOR: Manages a wide range of HR responsibilities, including contracts and compliance.

- PEO: Co-manages HR tasks with the client while providing a broader suite of HR services.

- Staffing Agency: Concentrates on the recruitment process, with minimal involvement in HR management post-hire.

FAQs

How can I select the best EOR service for my business needs?

To select the most suitable Employer of Record service, a company should assess the EOR’s experience in the relevant industry and geographical locations, consider the comprehensiveness of their services, verify their compliance with local laws and regulations, and evaluate their ability to support the company’s growth and operational needs.

What are the primary functions and responsibilities of an EOR?

An Employer of Record typically manages a range of human resources functions including payroll, taxation, employee benefits, and compliance with labor laws. They act as the legal employer for a company’s workforce, which can be especially valuable for companies expanding internationally and needing to navigate local employment regulations.

What should be included in an effective EOR agreement?

An effective Employer of Record agreement should clearly outline the services provided, delineate the responsibilities of each party, describe the terms of employment for workers, specify the fee structure, and include provisions for handling disputes and termination of the agreement.