In the mortgage industry, where both speed and accuracy are essential, an effective CRM can be transformative. It serves as a central repository for client information, allowing lenders to cultivate trust through personalized communication and tailored services. With technology advancing rapidly, today’s mortgage CRMs are equipped with features designed to manage leads, automate marketing, and facilitate loan processing, making them an indispensable tool for the business.

What we cover

Why Should Mortgage Brokers Use CRM Software

By incorporating CRM systems, mortgage professionals can effectively manage client information, automate marketing efforts, and improve lead generation strategies. Here are some of the main benefits of using CRM software as a mortgage broker:

Streamlined Client Management: CRM software enables mortgage brokers to keep track of clients’ information, documents, and communication within a centralized system. This makes it easier for loan officers to access and update client data, ensuring that each customer gets timely and personalized service.

Automation of Mundane Tasks: CRM automation is designed to handle repetitive tasks such as email marketing and follow-ups. This allows brokers to focus on more critical aspects of their job, such as closing deals and nurturing client relationships.

Enhanced Pipeline Management: By using CRM tools, brokers can monitor their sales pipeline, manage contacts, and track the progress of various loans more efficiently. This visibility into front-end operations aids in prioritizing tasks and deadlines.

Compliance with Regulations: CRM software often includes features that assist with regulation compliance, which is crucial for mortgage brokers. These systems ensure that all client communication and documentation adhere to industry standards and legal requirements.

Multi-Channel Marketing Capabilities: A comprehensive CRM platform generally offers multi-channel marketing capabilities, facilitating targeted outreach across various channels. This includes referral partner marketing, automated marketing campaigns, and more, providing a competitive advantage in a crowded market.

General Pricing of CRM Software for Mortgage Brokers

CRM pricing structures typically offer monthly subscription models, and may vary depending on a number of factors including features, integrations, and the size of the business. As of 2024, small businesses can anticipate a range starting from $14.90 per user per month to more premium options which can exceed $150 per user per month.

Example Pricing Tiers:

- Basic Tier: $14.90 – $20 per user per month, may include essential features suitable for individual brokers or small teams. Tends to offer pipeline management, contact databases, and rudimentary reporting.

- Mid-Range Tier: $99 – $150 per user per month, targeted towards established broker teams. This may include advanced communication tools, lead generation integrations, and transaction management.

- High-End Tier: Prices can exceed $150 per user per month, aligning with software that offers comprehensive features such as SMS automation, in-depth customization, and extensive integrations.

Features to Look for in CRM Software for Mortgage Brokers

When selecting CRM software, mortgage brokers should prioritize features that streamline their workflow and enhance client interactions. Here’s a closer look at essential functionalities:

Ease of Use and Customization:

CRM software should be user-friendly, allowing loan officers to quickly adapt and customize dashboards and workflows to fit their specific needs. Customizable fields and templates enable brokers to tailor their CRM to the unique demands of their businesses.

Robust Data Management and Reporting:

Efficient data management capabilities are crucial. The CRM should allow brokers to easily track borrower information, loan details, and have robust reporting tools to analyze performance, sales trends, and marketing campaigns effectively.

Integrated Loan Management Tools:

The ability to manage loans directly within the CRM is highly beneficial. Integrations with loan origination systems and document management features ensure that all loan-related activities can be tracked from initiation to closure within a single platform.

Marketing and Sales Features:

The CRM should provide powerful tools for running marketing campaigns and sales activities. This includes email marketing integrations, live chat functions, and automated marketing tasks to keep potential borrowers engaged.

Comprehensive Communication Channels:

Communicating with borrowers through their preferred channels enhances customer satisfaction. A mortgage CRM should offer a range of communication options, including SMS, email, and live chat interfaces, to facilitate seamless interactions throughout the borrowing process.

Best CRM Software for Mortgage Brokers

Each CRM listed here caters to the unique needs of the mortgage industry, offering a range of features from pipeline management to email marketing.

Act! is a popular CRM software designed to help small & medium-sized businesses manage contacts and marketing efforts effectively.

Salesforce is a leading cloud-based CRM platform that empowers businesses to enhance customer relationships and drive growth.

Freshsales is a user-friendly CRM software that aids businesses in automating sales processes and fostering customer relationships.

Monday.com is a cloud-based work operating system that enables organizations to create custom workflow apps to run projects.

Best CRM Software for Mortgage Brokers (At a Glance)

| Software | Focus Area | Key Features | Best For |

|---|---|---|---|

| Act! | Customization and marketing automation | Robust contact management, customization | Businesses seeking flexible CRM customization and marketing automation |

| Salesforce Financial Services Cloud | Deep customization and integration for financial services | Customization, integration capabilities, financial services-specific features | Financial services firms needing deep CRM customization and integration |

| HubSpot CRM | User-friendly interface and scalable marketing/sales features | Free core CRM, marketing and sales automation, integration capabilities | SMBs looking for a scalable, user-friendly CRM solution |

| Zoho CRM | Balance of functionality and affordability with customization | Customization options, affordability, good functionality | Businesses wanting an affordable CRM with good customization |

| Pipedrive | Visual sales pipeline management | Deal and communication tracking, user-friendly interface | Sales teams needing visual pipeline management and efficiency |

| Jungo | Mortgage industry-specific features and LOS integrations | Integrations with loan origination systems, industry-specific tools | Mortgage professionals requiring specific industry features and integrations |

| Velocify | High-velocity sales environments and lead management | Lead management, sales acceleration features | Teams in high-velocity sales environments focusing on lead management |

| Infusionsoft by Keap | Marketing and sales automation for small to medium businesses | Automation in marketing and sales processes, CRM functionality | Small to medium businesses looking for strong automation features |

| Mortgage iQ | Lead management, marketing automation, and analytics for mortgage industry | Lead management, marketing automation, robust analytics | Mortgage industry professionals needing specialized CRM tools |

| Total Expert | Marketing and customer engagement in compliance with industry regulations | Compliance management, customer engagement tools, analytics | Firms requiring compliance-ready marketing and engagement tools |

| Surefire CRM by Top of Mind | Content, marketing automation, and compliance tools for mortgage sector | Marketing automation, compliance management, content library | Mortgage sector businesses focusing on automated marketing and compliance |

| BNTouch Mortgage CRM | Digital marketing tools, automated workflows, and a mobile app for mortgage professionals | Automated communication workflows, digital marketing tools, mobile app | Mortgage professionals seeking comprehensive digital marketing and automation |

| Shape Software CRM | Streamlined operations with lead management, automation, and collaboration tools | Lead management, automation tools, team collaboration | Businesses needing streamlined operations with a focus on automation |

| Whiteboard CRM | Productivity enhancement, client relationship management, and loan process management | Productivity tools, client relationship and loan process management | Mortgage brokers looking for productivity and client management enhancements |

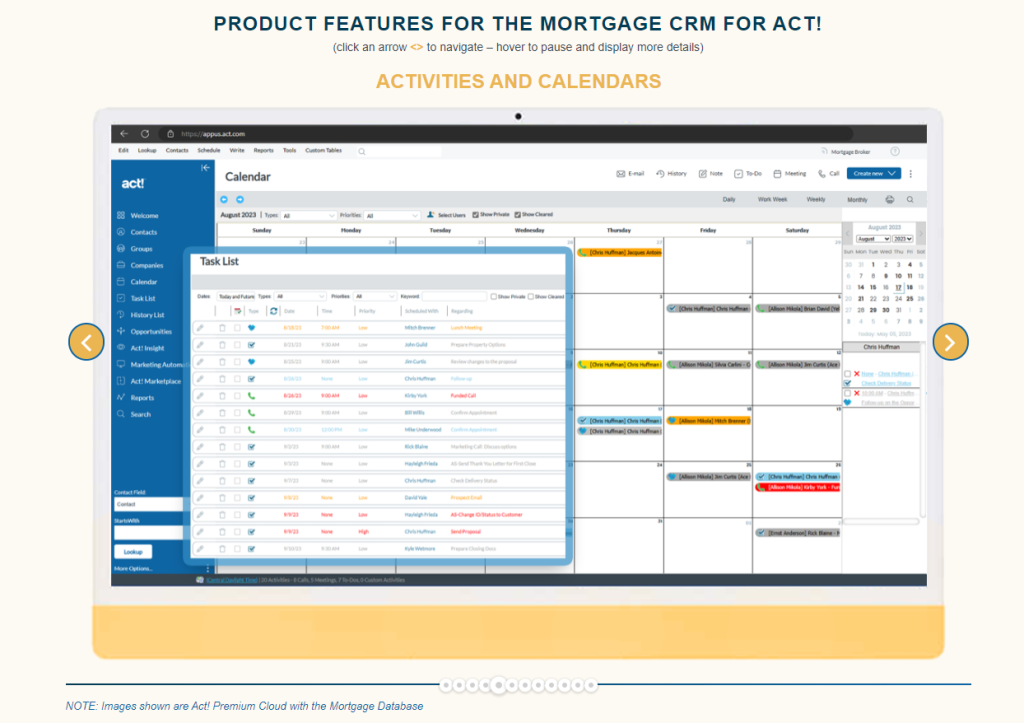

1. Act!

Key Features:

- Contact and lead management

- Marketing automation tools

- Integration with Microsoft products

Rating: 4.2/5

Pros:

- Comprehensive customer view

- Advanced marketing automation

- Customizable reports

Cons:

- Learning curve for new users

- Higher cost for full feature access

- Limited mobile app functionality

Pricing: Starting at $25/user/month

Act! CRM is renowned for its customization capabilities and marketing automation, making it a versatile choice for businesses seeking to tailor their CRM solution to their specific needs.

It offers robust contact management features that allow users to keep detailed records of customer interactions, driving more personalized communication strategies.

Act! is particularly beneficial for its ability to integrate with a wide range of third-party applications, enhancing its functionality.

Its user-friendly interface and comprehensive support resources make it a strong option for businesses looking to implement effective marketing campaigns and improve sales processes.

Verdict: Act! is recognized for its rich customizability and robust contact management capabilities, suitable for mortgage brokers who require detailed client profiles.

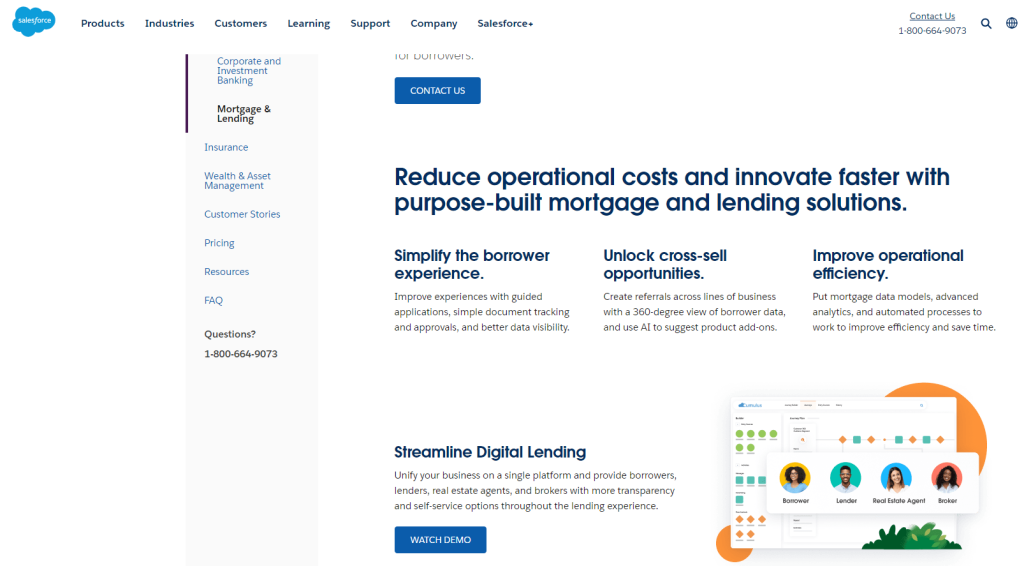

2. Salesforce Financial Services Cloud

Key Features:

- Tailored experience for financial services

- Deep analytics and reporting

- Extensive integration options

Rating: 4.5/5

Pros:

- Industry-specific features

- Scalable with business growth

- Wide range of integrations with third-party apps

Cons:

- Complex for beginners

- Potentially expensive with add-ons

- Time-consuming customization

Pricing: Custom pricing upon request

Salesforce Financial Services Cloud is designed specifically for the financial services industry, offering deep customization and integration capabilities.

Its strength lies in providing a 360-degree view of the customer, enabling personalized engagement and streamlined operations.

This CRM excels in compliance management, data security, and offers industry-specific features such as wealth management and banking solutions.

Its powerful analytics and reporting tools help financial professionals make informed decisions, enhancing customer relationships and driving growth.

Verdict: Salesforce Financial Services Cloud offers a powerful, industry-specific CRM platform for mortgage brokers who value analytics and customization.

Check out Salesforce Financial Services Cloud here!

3. HubSpot CRM

Key Features:

- Free version available

- Email tracking and notifications

- Pipeline and sales activity management

Rating: 4.4/5

Pros:

- User-friendly interface

- No cost for basic features

- Strong email marketing tools

Cons:

- Costs can add up with premium features

- Limited customization in free tier

- CRM becomes more complex with scale

Pricing: Free for basic; premium plans start at $45/month

HubSpot CRM is celebrated for its user-friendly interface and scalability, making it ideal for small to medium-sized businesses (SMBs).

It offers a comprehensive suite of free core CRM functionalities, including contact and deal management, email tracking, and pipeline visibility.

HubSpot stands out for its seamless integration with the broader HubSpot ecosystem, encompassing marketing, sales, and service hubs, which provides an all-in-one solution for growing businesses.

Its extensive library of integrations with other tools further enhances its versatility.

Verdict: HubSpot CRM strikes a balance between functionality and cost, making it accessible to mortgage brokers at various levels.

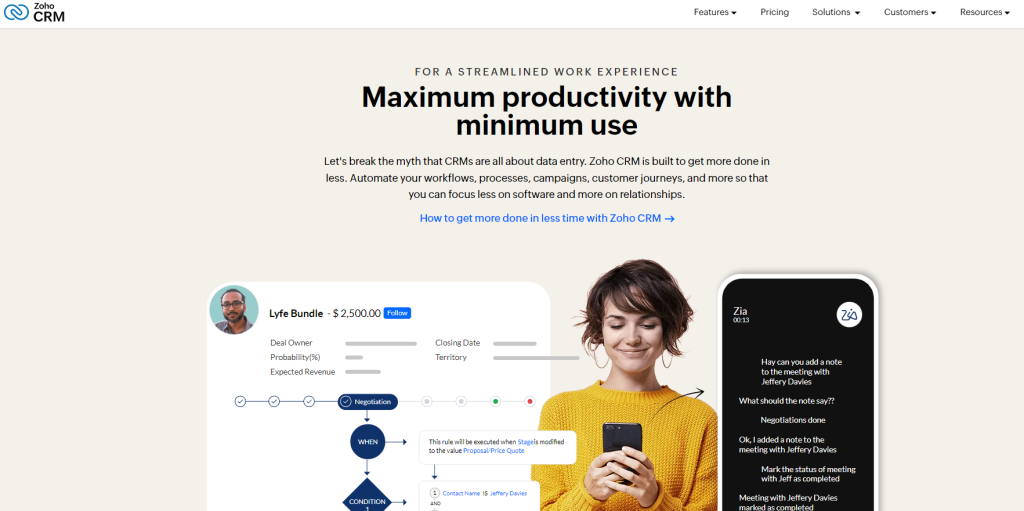

4. Zoho CRM

Key Features:

- Sales automation

- Workflow management

- Multichannel communication

Rating: 4.3/5

Pros:

- Affordable pricing tiers

- Extensive customization options

- Good third-party integration

Cons:

- Steep learning curve for the uninitiated

- Fragmented user experience in advanced features

- Support can be slow at times

Pricing: Starts at $14/user/month

Zoho CRM offers a perfect balance between functionality and affordability, with extensive customization options to meet the diverse needs of businesses.

It features automation of sales processes, multi-channel communication, and advanced analytics, helping businesses attract, retain, and satisfy customers efficiently.

Zoho CRM’s artificial intelligence assistant, Zia, provides sales predictions, lead scoring, and automation suggestions, enhancing sales productivity and decision-making.

Verdict: Zoho CRM is a budget-friendly option for brokers, offering a good balance of features against cost, especially for those keen on customization.

5. Pipedrive

Key Features:

- Visual pipeline management

- Email integration and tracking

- Sales reporting and forecasting

Rating: 4.5/5

Pros:

- Intuitive interface

- Strong focus on sales pipeline management

- Mobile app for on-the-go access

Cons:

- Limited capability for complex automation

- Basic reporting tools

- Lacks native document storage

Pricing: Starting at $15/user/month

Pipedrive is designed with a focus on visual sales pipeline management, making it highly effective for sales teams that prioritize efficiency and clarity in their sales process.

Its intuitive interface allows users to easily track deals and communications, while its customization options let teams tailor the system to their sales cycle.

Pipedrive’s strength lies in its simplicity and effectiveness in managing sales activities, supported by powerful analytics to monitor performance and optimize sales strategies.

Verdict: Pipedrive is acclaimed for its visually appealing pipeline management, benefiting brokers who prioritize ease of use and visual sales tracking.

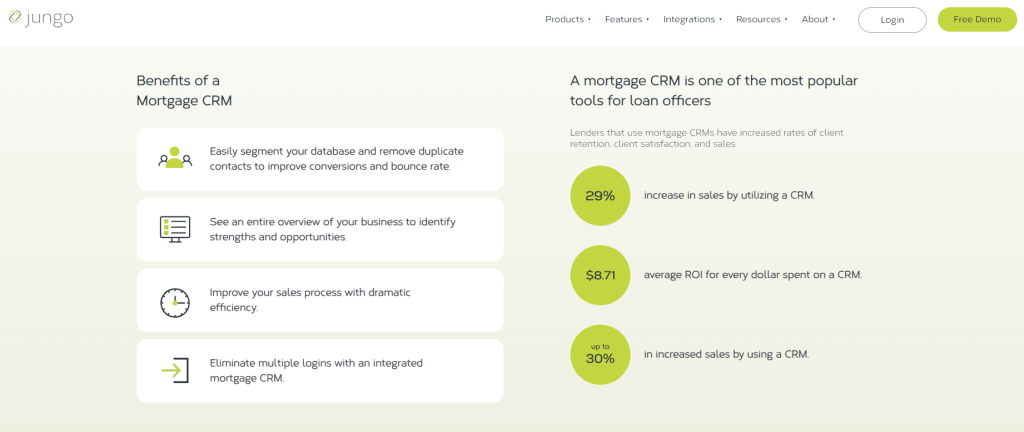

6. Jungo

Key Features:

- Built on Salesforce platform

- Loan origination software integration

- Mortgage-specific marketing tools

Rating: 4.1/5

Pros:

- Industry-targeted customizations

- Robust tracking and analytics

- Powerful LOS integrations

Cons:

- Can be pricey for small teams

- Requires Salesforce familiarity

- Configuration can be complex

Pricing: Custom pricing upon request

Jungo is a mortgage-specific CRM built on the Salesforce platform, offering comprehensive features tailored to the mortgage industry, including integrations with loan origination systems (LOS).

It automates marketing efforts, enhances customer relationship management, and ensures compliance, making it an invaluable tool for mortgage professionals.

Jungo’s customization capabilities allow for a highly personalized approach to client engagement and process management.

Verdict: Jungo leverages the robustness of Salesforce with added mortgage-specific functionality, ideal for brokers familiar with Salesforce seeking deep integration with LOS systems.

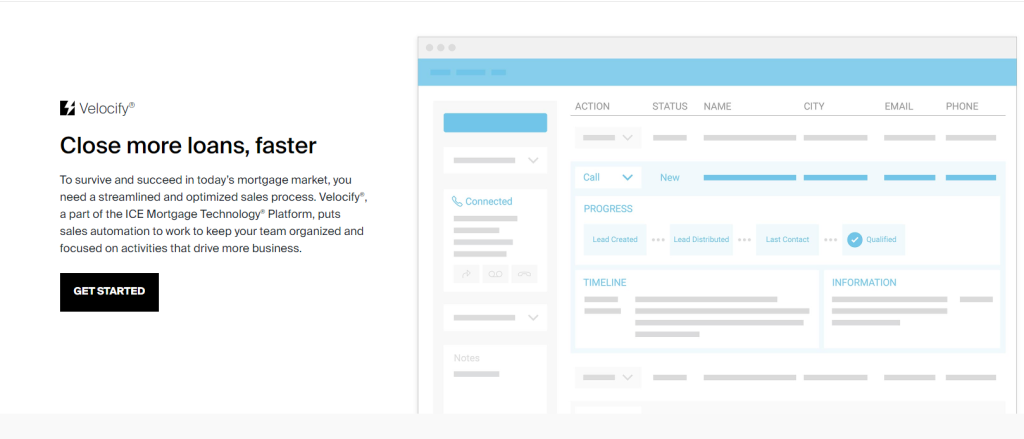

7. Velocify

Key Features:

- Lead distribution and prioritization

- Email and SMS marketing automation

- Performance analytics and reporting

Rating: 4.0/5

Pros:

- Efficient lead management system

- Strong automation capabilities

- Customizable workflows for mortgage processes

Cons:

- The interface may not be as modern

- Users report a learning curve

- Can become expensive with additional features

Pricing: Custom pricing upon request

Velocify is designed for high-velocity sales environments, offering lead management solutions that prioritize speed and efficiency.

It helps sales teams to quickly respond to leads, track their progress, and optimize sales strategies based on performance data.

Velocify’s automated dialer and email tracking functionalities are key features that enable sales teams to increase their outreach and follow-up effectiveness, making it a powerful tool for boosting sales productivity.

Verdict: Velocify offers specialized lead management tools that support brokers in prioritizing and converting leads effectively.

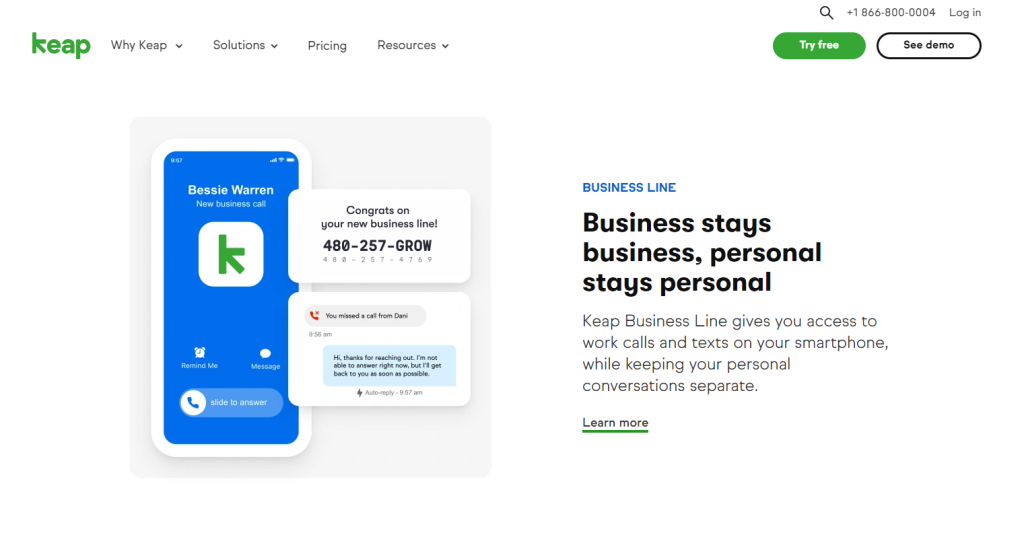

8. Keap

Key Features:

- Advanced automation for sales and marketing

- CRM and email marketing integration

- Customizable campaign builders

Rating: 4.1/5

Pros:

- Strong marketing automation capabilities

- Good for scaling small businesses

- Comprehensive customer tracking

Cons:

- High initial cost for setup

- Complexity requires a learning curve

- Additional costs for more contacts and features

Pricing: Starting at $79/month

Keap is tailored for small to medium businesses, providing robust marketing and sales automation features that help businesses grow by attracting more leads, improving conversion rates, and enhancing customer service.

Its CRM functionality is complemented by advanced email marketing, payment processing, and e-commerce capabilities, making it a comprehensive solution for businesses looking to automate and streamline their operations.

Verdict: Keap is recommended for brokers who demand extensive marketing automation with their CRM, despite the potential complexity.

9. Mortgage iQ

Key Features:

- Marketing automation

- Referral partner tracking

- Customizable loan status triggers

Rating: 4.2/5

Pros:

- Sector-specific design

- Strong lead nurturing tools

- Tailored for complex mortgage sales cycles

Cons:

- Can be expensive for smaller operations

- Not as intuitive for newcomers

- Setup and customization may require professional assistance

Pricing: Custom pricing upon request

Mortgage iQ is a CRM specifically designed for the mortgage industry, offering lead management, marketing automation, and robust analytics.

It helps mortgage brokers and lenders manage client relationships throughout the loan process, from lead acquisition to post-closing, with efficiency and compliance.

Its strength lies in its comprehensive feature set that addresses the unique needs of the mortgage sector, including integration with major loan origination systems.

Verdict: Mortgage iQ excels in handling the nuanced mortgage sales process, propelling brokers who desire a mortgage-centric CRM.

10. Total Expert

Key Features:

- Customer co-marketing platform

- Content library for mortgage marketing

- Compliance and document management

Rating: 4.3/5

Pros:

- Custom content creation for marketing

- Strong regulatory compliance features

- Collaboration tools for partners

Cons:

- Learning curve for non-tech-savvy users

- Set up can be time-consuming

- Potentially limited customization

Pricing: Custom pricing upon request

Total Expert focuses on marketing and customer engagement within the financial services industry, ensuring compliance with industry regulations.

It offers a powerful marketing automation platform that enables personalized communication and engagement with clients across various channels.

Total Expert’s analytics and insights help firms understand customer behavior and preferences, driving more effective marketing strategies and improving customer experiences.

Verdict: Total Expert focuses on content and compliance, benefiting mortgage companies seeking collaborative marketing and compliance tools.

11. Surefire CRM by Top of Mind

Key Features:

- Automated email campaigns

- Customizable marketing workflows

- Dynamic mortgage event notifications

Rating: 4.4/5

Pros:

- Highly regarded for its marketing automation

- Intuitive user experience

- Comprehensive content library

Cons:

- Slightly higher cost than some competitors

- Can be overkill for very small businesses

- Customization may require extra time

Pricing: Starts at $65/user/month

Surefire CRM by Top of Mind is designed for the mortgage industry, offering content marketing, marketing automation, and compliance management tools.

It stands out for its extensive content library, which allows mortgage professionals to engage clients with timely, relevant, and compliant messaging.

Surefire’s automation features streamline communication workflows, ensuring consistent and effective client engagement.

Verdict: Surefire CRM excels in marketing automation, providing brokers with a suite of tools to keep customers engaged.

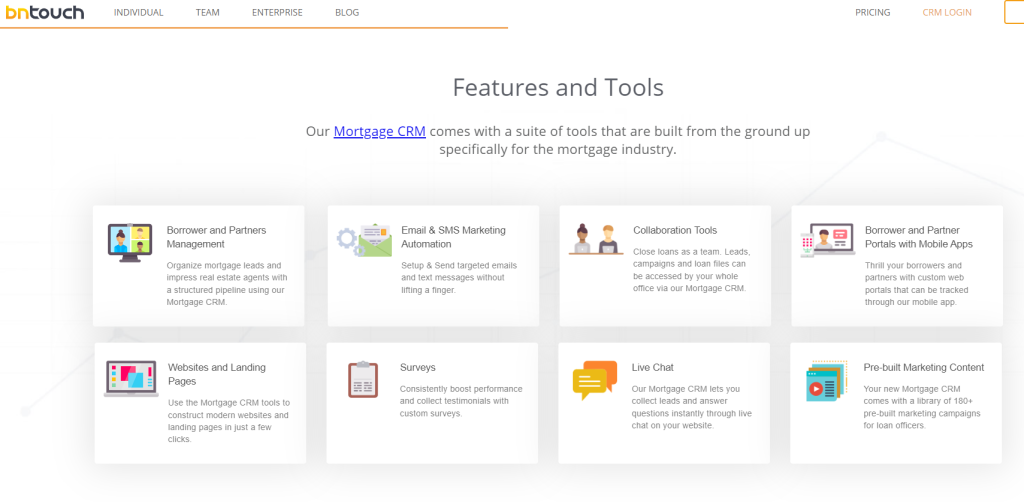

12. BNTouch Mortgage CRM

Key Features:

- Multichannel marketing strategies

- Integration with loan origination systems

- Mortgage-specific video marketing

Rating: 4.2/5

Pros:

- Designed expressly for mortgage professionals

- Diverse lead generation tools

- Educational content for clients

Cons:

- Interface may feel outdated

- Customer support availability varies

- Occasional system lag reported

Pricing: Starting at $68/user/month

BNTouch Mortgage CRM offers a comprehensive suite of digital marketing tools, automated communication workflows, and a mobile app, making it a complete solution for mortgage professionals.

Its customizable marketing campaigns, borrower and partner portals, and robust integrations with loan origination systems streamline the mortgage process, enhancing client satisfaction and referral business.

Verdict: BNTouch Mortgage CRM stands out for its tailored approach to mortgage brokering, combining educational resources with effective lead gen tools.

Check out BNTouch Mortgage CRM here!

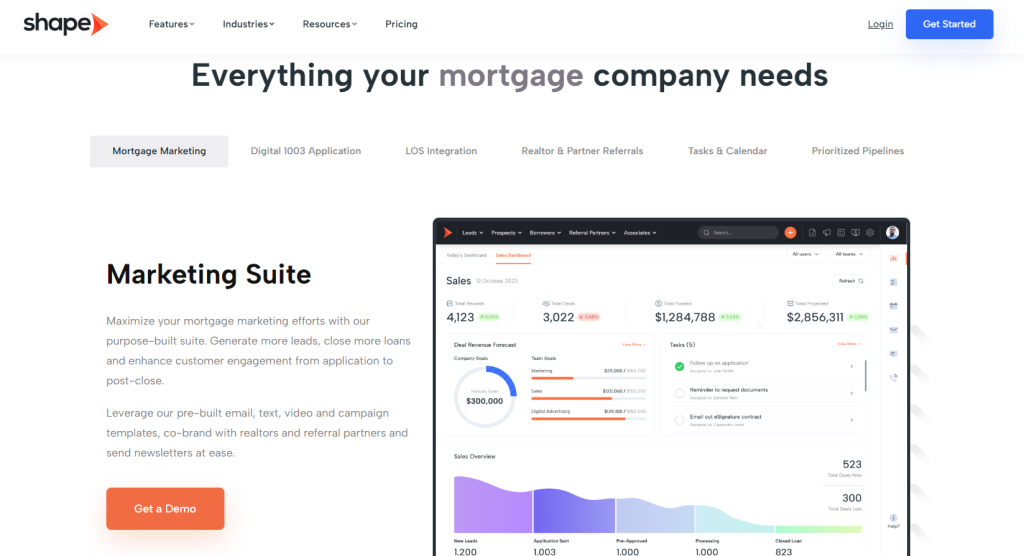

13. Shape Software CRM

Key Features:

- Loan pipeline management

- SMS and email campaign automation

- Intuitive lead nurturing

Rating: 4.1/5

Pros:

- User-friendly layout

- Strong focus on mortgage industry needs

- Seamless task automation

Cons:

- May lack depth in reporting capabilities

- Custom features can increase cost

- Initial setup requires time

Pricing: Custom pricing upon request

Shape Software CRM is designed to streamline operations for businesses across various industries, including mortgage brokerage.

It offers lead management, automation, and team collaboration tools, making it an effective solution for managing sales processes, customer interactions, and internal workflows.

Shape’s user-friendly interface and customizable features ensure that businesses can adapt the CRM to their specific needs, improving efficiency and productivity.

Verdict: Shape Software CRM provides a clear and concise platform for mortgage lenders, highlighting its strong point in task automation.

Check out Shape Software CRM here!

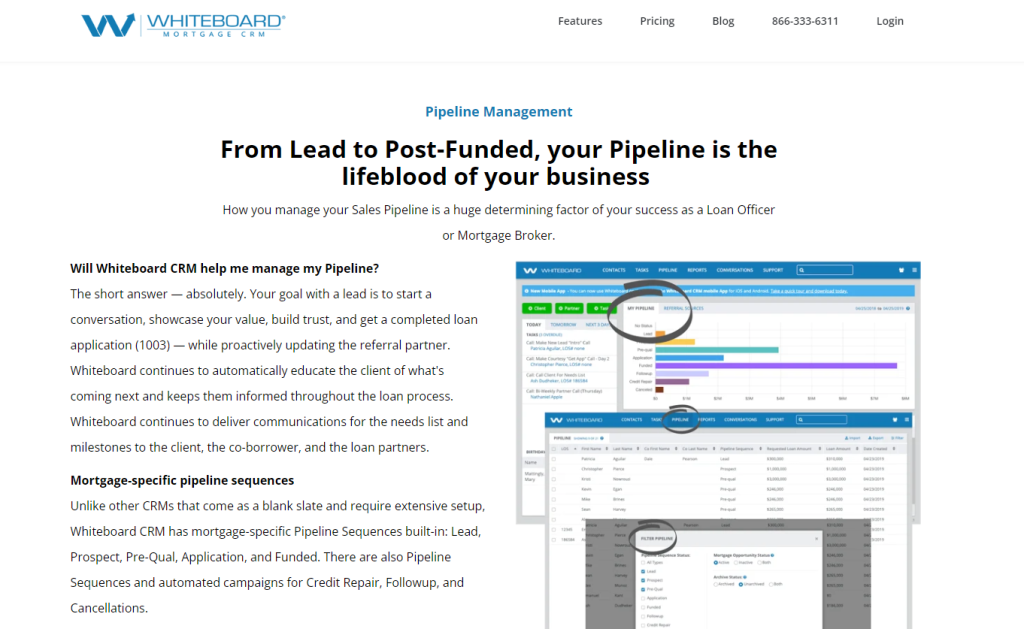

14. Whiteboard CRM

Key Features:

- SMS and email automation

- Lead generation integrations

- Transaction management

Rating: 4.6/5

Pros:

- Strong communication features

- Comprehensive lead management

- Effective transaction tracking

Cons:

- Pricier than some alternatives

- May have more features than needed for small businesses

- Requires commitment to benefit fully

Pricing: Starts at $150/month per user

Whiteboard CRM is tailored for mortgage professionals, focusing on productivity enhancement, client relationship management, and loan process management.

It offers workflow automation, team collaboration tools, and client communication features, designed to streamline the mortgage process from lead to close.

Whiteboard CRM’s strength lies in its ability to improve operational efficiency, enhance customer engagement, and ensure compliance throughout the loan lifecycle.

Verdict: Whiteboard CRM’s specialty lies in its communication tools and transaction management, making it a top choice for brokers who place a premium on automation and lead integrations.

Check out Whiteboard CRM here!

FAQs

What are the pros and cons of free CRMs for mortgage brokers?

Free CRM systems can be beneficial for mortgage brokers who are just starting out or have a limited budget. They typically offer basic features that allow for contact management and task scheduling. However, as a broker’s business grows, these free CRMs may lack advanced functionalities like automation, reporting, and customization. Additionally, free versions often come with limitations on the number of users and contacts, and the lack of dedicated support can be a drawback.

What integrations are important for a mortgage broker CRM?

For mortgage brokers, it’s crucial that their CRM integrates seamlessly with loan origination software (LOS), email marketing tools, and document management systems. Integration with credit scoring services and compliance management tools can also significantly streamline the lending process. These integrations can help brokers efficiently manage client information, automate routine tasks, and ensure timely follow-ups, leading to improved client satisfaction and compliance with industry regulations.

How does a CRM improve client management for mortgage brokers?

A CRM system enhances client management for mortgage brokers by centralizing client information and interactions. This centralization allows for a more personalized approach to client communications and easier tracking of the loan process. Automation features within a CRM can prompt brokers when to reach out to clients and remind them of important milestones, ensuring a consistent and proactive service delivery. Comprehensive CRMs also offer reporting tools that aid in identifying trends and opportunities for business growth.