In the insurance industry, where customer relationships and efficient management of leads are pivotal, an effective CRM solution can be the difference between a thriving agency and one that struggles to keep up. Insurance CRMs are designed to cater to the specific needs of agents and brokers, providing tools for contact management, sales tracking, and policy management, all while ensuring compliance with industry regulations.

It’s essential for those in the insurance sector to choose a CRM that is tailored to their unique needs. The ideal software should provide a seamless integration of client information, policy details, and communication histories. Moreover, it should offer scalability and adaptability to conform to an agency’s changing requirements, and possess a user-friendly interface that mitigates the learning curve for agents and supports better adoption rates within the firm.

What we cover

Why Should Insurance Agents Use CRM Software

CRM software provides an integrated approach to managing client relationships, streamlining sales and marketing efforts, while ensuring service excellence. Insurance agents stand to gain substantially from leveraging CRM tools, as they bring efficiency and organization to the forefront of insurance agency operations.

Top Benefits for Insurance Agents:

- Enhanced Lead and Contact Management: CRM systems offer sophisticated lead management features, enabling agents to score, track, and nurture leads through the sales pipeline with greater precision. Organizational features like segmentation can improve targeting for marketing campaigns, potentially increasing conversion rates.

- Sales and Marketing Automation: Automation allows for the routine tasks of sales processes, such as follow-ups and policy renewals, to be conducted systematically, which frees up agent time for client interactions and tailoring insurance solutions to individual client needs.

- Improved Customer Service and Support: By centralizing customer information, CRM tools help agents resolve claims effectively and deliver a personalized service experience. Dashboard interfaces enable quick access to customer data and history, enhancing the quality and response time of customer support.

- Data-Driven Insights and Reporting: CRMs offer robust analytics and reporting capabilities, facilitating data-driven decisions that align with agency growth objectives. These insights aid in sales forecasting and commission tracking, offering a clearer picture of an agency’s performance.

- Increased Operational Efficiency: Integration with different tools and applications within the agency system streamlines operations, reduces errors, and improves collaboration across teams. This operational flexibility enables insurance brokers to manage workflows and communications more efficiently, contributing to both top-line growth and enhanced customer relationships.

General Pricing of CRM Software for Insurance Agents

CRM software for insurance agents comes in various pricing tiers, designed to cater to the size and scope of the agency’s operations. Generally, prices for insurance-specific CRMs can range significantly depending on functionality, number of users, and integration capability.

Pricing varies from free or low-cost solutions suitable for individuals or small businesses to high-tier plans for larger agencies that require advanced features. Here’s an overview of the typical costs one may expect:

- Free Plans: Some general-use CRMs offer free basic plans that provide limited features sufficient for single users or new agents.

- Entry-Level Plans: A starting price for small businesses could be as low as $10-$15 per user/month, providing essential CRM functions.

- Mid-Range Plans: For growing agencies, prices tend to range from $50 to $100 per user/month.

- High-End Plans: Large insurance firms might expect to invest $100+ per user/month on CRMs with extensive features like advanced analytics.

It’s important to assess the CRM’s value based on how well it caters to insurance-specific workflows, such as lead management, policy renewals, and client communications:

| CRM Features | Small Agency | Mid-Sized Agency | Large Agency |

|---|---|---|---|

| Lead Management | Basic automation and client tracking | Advanced segmentation and lead scoring | Integrated marketing and lead handling |

| Policy Renewal | Manual reminders and follow-ups | Automated renewals and notifications | Custom workflow automation |

| Communications | Email templates and logging | Multi-channel communication; activity tracking | Comprehensive client service solutions |

Features to Look for In CRM Software for Insurance Agents

When selecting CRM software for insurance agents, several key features are imperative to enhancing business operations and client service. These features streamline tasks, manage workflows, and ensure that agents can focus on their core functions of selling and managing insurance policies.

- Lead Management: Robust CRM tools provide comprehensive lead management capabilities, allowing agents to track leads through every stage of the sales pipeline. Effective lead management aids in prioritizing prospects and organizing follow-up efforts to maximize conversion rates.

- Policy and Commission Tracking: Insurance-specific CRMs should facilitate tracking of client policies and the associated commissions. Having an integrated system ensures accurate monitoring of earnings, renewals, and policy changes.

- Sales and Marketing Automation: Automation features expedite repetitive tasks such as email marketing campaigns and client follow-ups. Implementing sales automation in the CRM can enhance productivity by enabling agents to focus more on selling and less on manual processes.

- Analytics and Reporting: Access to advanced analytics helps agents understand performance metrics and sales trends. Smart lists and customizable dashboards provide insights for informed decision-making and strategy development.

- Third-party Integrations: To maximize efficiency, a CRM should offer third-party integrations with other vital tools such as calendaring, email, and document management solutions. These integrations ensure a seamless workflow and eliminate the need for multiple disconnected applications.

Top Recommendations

monday.com is a collaborative operating system that simplifies task management, project tracking, and team communication.

Act! is a popular CRM software designed to help small & medium-sized businesses manage contacts and marketing efforts effectively.

Best CRM Software for Insurance Agents

Selecting the best CRM software is critical for insurance agents looking to streamline their sales processes, improve customer relations, and enhance overall efficiency. Different CRM platforms offer unique features tailored to the insurance industry, focusing on lead management, policy tracking, and seamless integration with other tools.

Best CRM Software for Insurance Agents (At a Glance)

| CRM Software | Focus Area | Key Features | Best For |

|---|---|---|---|

| HubSpot CRM | Ease of use, integration capabilities | Contact management, email tracking, sales pipeline | Small to medium businesses, marketing-focused agencies |

| Salesforce Sales Cloud | Customizability, extensive feature set | Lead management, sales forecasting, analytics | Large businesses, sales professionals |

| Zoho CRM | Affordability, range of features | Lead and contact management, automation | Small to medium businesses, diverse industries |

| Pipedrive | Sales pipeline management | Visual sales stages, activity tracking | Sales teams, small to medium businesses |

| Insureio | Insurance industry-specific | Policy management, marketing automation | Insurance agents, policy management |

| Applied Epic | Comprehensive policy management | Policy lifecycle management, reporting | Large insurance agencies, complex workflows |

| Radiusbob | Lead management, insurance-focused | Lead management, carrier integration | Insurance agents and brokers |

| Bitrix24 | Complete suite, collaboration tools | CRM, project management, communication tools | Teams requiring collaboration, diverse functionalities |

| AgencyBloc | Insurance agency management | Policy and agent management, analytics | Insurance agencies, commission tracking |

| Microsoft Dynamics 365 | Customization, extensive integration | CRM and ERP tools, robust analytics | Large businesses, need for customization |

| Freshsales | AI-based insights, ease of use | Lead scoring, visual pipelines, email tracking | Sales-focused teams, small to medium businesses |

| Copper | Google Workspace integration | CRM, pipeline management, Google app integration | Google Workspace users, small to medium businesses |

| AMS360 by Vertafore | Comprehensive agency management | Policy management, billing, document management | Large insurance agencies, comprehensive needs |

| Equisoft/connect | Financial and insurance industry-specific | Policy management, client profiling, automation | Insurance and financial professionals, specialized needs |

1. Hubspot CRM

Key Features:

- Free CRM core solution

- Marketing and sales automation

- Robust reporting tools

Rating: 4.5/5

Pros:

- No cost for the basic version

- Intuitive user interface

- Extensive integration capabilities

Cons:

- Premium features can be costly

- May be too complex for small agencies

- Limited customization for the free version

Pricing: Free with premium features starting at $45/month

HubSpot CRM is renowned for its ease of use and its ability to streamline the sales process. It offers a free version with basic features and paid versions with additional functionalities. Key features include contact and lead management, email tracking, and a sales pipeline dashboard.

It’s particularly beneficial for insurance agents due to its powerful integration capabilities with HubSpot’s marketing, sales, and service hubs, providing a comprehensive toolset for managing customer relationships, automating marketing efforts, and improving customer service.

Verdict: Hubspot CRM is a strong contender due to its comprehensive set of features at no initial cost, making it accessible for insurance agents of all sizes.

2. Salesforce Sales Cloud

Key Features:

- Salesforce Financial Services Cloud

- Customizable sales process

- Advanced analytics and forecasting

Rating: 4.6/5

Pros:

- Highly customizable CRM platform

- Detailed reporting and analytics

- Extensive third-party ecosystem

Cons:

- Steeper learning curve

- More expensive than some competitors

- Can be resource-heavy for smaller agencies

Pricing: Starting from $25/user/month

Salesforce Sales Cloud is a highly customizable CRM platform known for its advanced features and extensive ecosystem of third-party apps. It offers comprehensive solutions for lead management, sales forecasting, contact management, and workflow automation.

For insurance agents, Salesforce’s robust analytics, reporting tools, and customizable dashboards are invaluable for tracking client interactions and sales performance, making it easier to identify trends and opportunities.

Verdict: Renowned for its powerful customization and comprehensive features, Salesforce Sales Cloud suits insurance agencies focusing on scalability and in-depth customer engagement.

Check out Salesforce Sales Cloud here!

3. Zoho CRM

Key Features:

- Sales automation and marketing tools

- Multichannel communication

- AI-powered analytics

Rating: 4.3/5

Pros:

- Affordable pricing for small to mid-size businesses

- User-friendly interface

- Rich in features and automation capabilities

Cons:

- Limited functionality for the free version

- Occasional complexity in setup

- Additional costs for full feature access

Pricing: Free limited version, standard plans start at $14/user/month

Zoho CRM is popular for its affordability and the wide range of features it offers, including lead and contact management, sales pipeline management, and performance metrics.

It’s highly customizable and integrates well with other Zoho products, such as Zoho Campaigns for email marketing.

Insurance agents benefit from its automation capabilities, which streamline complex processes and its AI assistant, Zia, which provides predictive sales insights.

Verdict: Zoho CRM offers a balance between functionality and affordability, providing insurance agents with a flexible and user-friendly CRM solution.

4. Pipedrive

Key Features:

- Visual sales pipeline management

- Customizable interface

- Email integration

Rating: 4.4/5

Pros:

- Emphasizes sales pipeline visibility

- Streamlined interface enhances efficiency

- Strong mobile app support

Cons:

- Limited functionality for complex CRM needs

- Primary focus on sales pipeline may neglect other CRM aspects

- Reporting can be basic compared to others

Pricing: Starting at $12.50/user/month

Pipedrive is designed with sales teams in mind, focusing on managing the sales pipeline efficiently. Its interface is user-friendly, and it provides excellent visualization of the sales stages.

Features like goal setting and reporting, email integration, and the customizable dashboard make it a good fit for insurance agents who need a clear, concise view of their sales funnel and the ability to track client interactions meticulously.

Verdict: Pipedrive stands out for insurance agents due to its strong focus on visual sales pipeline management, aiding agents in tracking deals with ease.

5. Insureio

Key Features:

- Insurance-focused CRM platform

- Marketing and sales automation

- Client management tools

Rating: 4.1/5

Pros:

- Designed specifically for the insurance sector

- Streamlines communication with potential and current clients

- Comprehensive lead management

Cons:

- More niche market may limit broader CRM functionality

- Learning curve for new users in insurance industry

- Limited integration with non-insurance tools

Pricing: Starting at $25/month with tiered pricing based on feature access

Insureio is specifically designed for the insurance industry. It offers policy management, marketing automation, commission tracking, and detailed reporting.

Its strength lies in its niche focus – it understands the specific needs of insurance agents and offers solutions to manage clients, policies, and marketing in one platform, making it an all-in-one solution for insurance professionals.

Verdict: Insureio offers tailored features for those in the insurance industry, making it a highly relevant tool for managing client insurance policies and services.

6. Applied Epic

Key Features:

- Agency management

- Advanced reporting features

- Customer engagement tools

Rating: 4.2/5

Pros:

- Comprehensive enterprise solution

- Strong focus on insurance operations

- Scalable for large agencies

Cons:

- Can be expensive for small firms

- Complexity can lead to extended implementation times

- Requires training to maximize its use

Pricing: Pricing provided on request

Applied Epic is widely used in the insurance sector. It’s a comprehensive system offering features for managing the entire lifecycle of policy management, from sales to renewal. It also offers advanced reporting, integrated email, and document management.

Its strong suit is its ability to handle complex insurance workflows, making it suitable for larger insurance agencies that require a robust, all-encompassing system.

Verdict: Applied Epic is a robust option for larger insurance agencies requiring an enterprise-level solution, offering extensive features for managing client relationships.

7. Radiusbob

Key Features:

- Lead management and distribution

- Quote engine integration

- Email and marketing automation

Rating: 4.0/5

Pros:

- Tailored to the insurance industry

- Supports task automation and workflow management

- Built-in telephony for communication

Cons:

- User interface less intuitive than some competitors

- Less well-known might mean smaller support community

- Occasionally reported as slow or laggy

Pricing: Starts at approximately $34/month

Radiusbob is tailored for insurance agents and brokers, focusing on lead management, client management, and marketing automation. It offers integrations with major insurance carriers and lead providers.

Its automation tools for emails and workflows, along with its detailed analytics, make it a valuable asset for insurance agents looking to streamline their operations and focus on growing their client base.

Verdict: Radiusbob is a specialized CRM tool for insurance agents that integrates well within the insurance sales process, particularly in lead management.

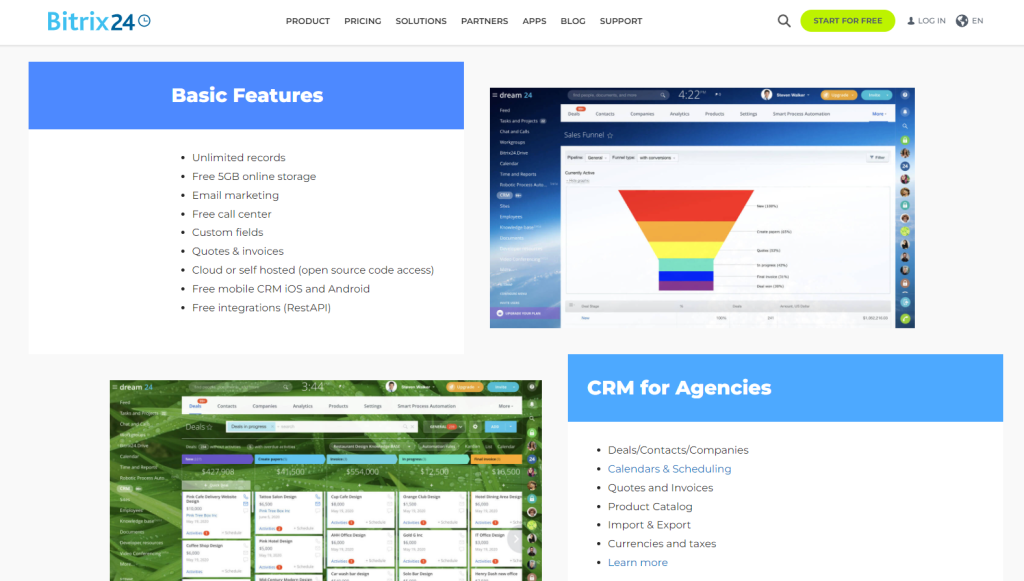

8. Bitrix24

Key Features:

- Collaboration tools

- Communication via email, phone, and social media

- CRM and project management integration

Rating: 4.2/5

Pros:

- Comprehensive free plan available

- Flexible platform with wide-ranging features

- Good for both sales and collaboration

Cons:

- Interface can be overwhelming due to breadth of features

- Premium plans can be pricey compared to some CRM-only solutions

- May offer more than needed for small insurance teams

Pricing: Free, with business plans starting at $39/month

Bitrix24 offers a complete suite of tools, including CRM, project management, website building, and communication tools.

For insurance agents, its CRM functionalities are most relevant, offering contact management, sales automation, and pipeline management.

Its strong collaboration tools and ability to centralize all customer interactions are particularly beneficial for teams looking to enhance productivity and client service.

Verdict: For insurance agents in need of robust task and project management alongside CRM functionality, Bitrix24 presents a versatile option.

9. AgencyBloc

Key Features:

- Automated workflow capabilities

- Lead and policy tracking

- Detailed reporting analytics

Rating: 4.3/5

Pros:

- Tailored specifically for insurance agencies

- Comprehensive agency management tools

- Strong focus on life and health insurance sectors

Cons:

- May not be as scalable for large enterprises

- Limited customization options

- Initial learning curve for new users

Pricing: Starts at $65 per month per user; additional fees for added functionality.

AgencyBloc is a CRM specifically designed for insurance agencies. It offers policy and agent management, commission processing, and detailed analytics. Its automation tools for emails and workflows help agencies streamline operations.

AgencyBloc stands out for its focus on the insurance market, providing tailored solutions for managing policies, commissions, and client relations.

Verdict: AgencyBloc is recommended for its specialized features that cater to the unique needs of the insurance space.

10. Microsoft Dynamics 365

Key Features:

- Extensive customer data insights

- Integration with other Microsoft products

- Advanced sales and marketing automation

Rating: 4.4/5

Pros:

- Highly customizable and scalable

- Strong analytics and reporting tools

- Familiar interface for those who use other Microsoft products

Cons:

- Can be complex to set up and maintain

- Higher cost can be a barrier for smaller firms

- The extensive range of features might be overwhelming

Pricing: Basic plans for small and medium businesses start at $65 per user per month.

Microsoft Dynamics 365 offers a range of CRM and ERP tools. It’s known for its flexibility and extensive integration capabilities.

For insurance agents, its strength lies in its customization options and robust analytics, which help in managing client relationships more effectively and gaining insights into sales performance.

Verdict: Microsoft Dynamics 365’s integration capabilities make it a potent tool for insurance firms looking for extensive customization and deep customer insights.

Check out Microsoft Dyanmics 365 here!

11. Freshsales

Key Features:

- Integrated phone and email with AI-driven insights

- Advanced lead scoring and sales pipeline visibility

- Mobile access with full feature set

Rating: 4.5/5

Pros:

- User-friendly interface for straightforward adoption

- Comprehensive sales and marketing tools

- Effortless integration with other business systems

Cons:

- A smaller set of insurance-specific features

- Additional cost for premium support

- The AI functionalities may require a learning curve

Pricing: Offers a free version; paid plans start at $15 per user per month.

Freshsales is recognized for its intuitive user interface and AI-based insights. It offers lead scoring, visual sales pipelines, and email tracking.

Insurance agents benefit from its AI-powered insights, which help prioritize leads and opportunities, and its strong automation capabilities, which streamline sales processes.

Verdict: Freshsales boasts a strong overall package with its user-friendly interface and AI-driven functionalities, facilitating effective engagement and sales processes.

12. Copper

Key Features:

- Seamless integration with G Suite

- Visual pipeline management tools

- Collaboration-centered interface

Rating: 4.2/5

Pros:

- Intuitive interface with minimal training required

- Strong focus on task and project management

- Effective for team collaboration within insurance CRM activities

Cons:

- Limited reporting capabilities compared to competitors

- Some integrations with non-Google products may be lacking

- G Suite reliance may be limiting for non-Google users

Pricing: Plans start at $25 per user per month.

Copper is known for its integration with Google Workspace, making it a good choice for teams heavily invested in Google’s ecosystem. It offers a user-friendly interface with features like lead and pipeline management.

For insurance agents using Google Workspace, Copper provides a seamless experience with minimal data entry, as it automatically collects and organizes data from Gmail and other Google apps.

Verdict: Copper excels in its tight integration with Google Workspace, offering an easy-to-use CRM for agencies using Google for their primary services.

13. AMS360 by Vertafore

Key Features:

- Comprehensive agency management

- Integrated accounting tools

- Configurable data fields and workflows

Rating: 4.0/5

Pros:

- Industry-specific functionalities for the insurance sector

- Robust data management and document handling

- Strong compliance and security features

Cons:

- Interface may seem outdated to some users

- Can be costly for small businesses

- Customization requires technical know-how

Pricing: Pricing is not publicly listed; requires a quote based on agency size and needs.

AMS360 is a robust platform offering policy management, integrated billing, and document management. It’s designed to streamline agency workflows, improve client relationships, and enhance overall agency productivity.

Its comprehensive features make it suitable for insurance agencies looking for a detailed, all-in-one solution for managing their operations.

Verdict: AMS360 by Vertafore delivers specialized insurance agency management solutions with a comprehensive set of features for data handling and compliance.

14. Equisoft/connect

Key Features:

- Policy and client data aggregation

- Customizable dashboards and reports

- Client portal for self-service

Rating: 4.1/5

Pros:

- Centralized data makes it easier to manage client information

- Streamlined communication via client portal

- Flexibility in managing different types of insurance portfolios

Cons:

- Potentially steep learning curve for more complex features

- Some users require more customization than is available

- Integration with other tools may be limited

Pricing: Contact for a tailored pricing plan.

Equisoft/connect is tailored for the financial and insurance industries, offering a wide range of CRM functionalities. It’s particularly strong in policy management, client profiling, and workflow automation.

Its industry-specific features make it an excellent choice for insurance agents looking for a CRM that caters specifically to their unique needs.

Verdict: Equisoft/connect provides insurance agents with a centralized platform for managing a broad range of insurance products and client communications effectively.

Check out Equisoft/connect here!

FAQs

How does a specialized CRM for health insurance differ from other CRM systems?

A specialized CRM for health insurance is designed to cater to the unique needs of health insurance agents and brokers. It often includes specific features for managing policy renewals, tracking regulatory compliance, and facilitating in-depth client health data analysis. Unlike generic CRMs, these systems integrate seamlessly with industry-specific tools and provide targeted insights that can lead to more effective client management and retention strategies within the health insurance sector.

Are there any highly-rated free CRM solutions suitable for insurance agents?

While the market is more limited for free CRM solutions that address all the needs of insurance agents, there are highly-rated platforms that offer key functionalities without a cost. Often, free CRMs can provide basic contact management, lead tracking, and task scheduling, which can significantly benefit insurance agents at the start of their practice or are operating with a limited budget. However, these free versions may lack the comprehensive features provided by paid insurance CRM software, such as integration with insurance-specific tools and advanced automation capabilities.