Choosing the right CRM software involves evaluating how well it aligns with the business objectives of loan officers and their respective organizations. The ideal CRM should offer seamless integrations and easy setup, ensuring a minimal learning curve while providing robust features to enhance client management. Automation capabilities are particularly critical as they help loan officers in lead generation, follow-up scheduling, and in managing the overall loan process efficiently.

Moreover, the best CRM platforms are those that offer comprehensive support, intuitive interfaces, and adaptability to the ever-changing mortgage landscape. With client satisfaction as a priority, these systems must facilitate stronger, more consistent client relationships while adhering to the industry’s compliance standards. As loan officers navigate the complexities of the mortgage process, a CRM that can provide comprehensive solutions to manage their workload can become a key asset in achieving their goals.

What we cover

Benefits of Using CRM Software for Loan Officers

Effective Lead Management: CRM software enables loan officers to systematically track and sort leads, ensuring that no potential borrower slips through the cracks. By automating lead nurturing processes, loan officers can maintain consistent communication with prospective clients.

Streamlined Pipeline Management: The organization of a loan officer’s pipeline is critical for tracking the progress of loan origination. CRM solutions provide a clear view of where each borrower is in the process, allowing for timely follow-ups and efficient movement through the pipeline.

Enhanced Communication: A CRM platform often includes built-in calling and texting features, which facilitate easier, more organized, and more trackable interactions with clients. This improved communication helps loan officers to build stronger relationships with borrowers.

Marketing Automation: Implementing marketing automation within a CRM allows for targeted campaigns, personalized messaging, and a marketing suite that works in sync with contact management. This efficient approach can lead to an increased return on investment (ROI) by optimizing marketing efforts.

Comprehensive Reporting and Analytics: CRMs are equipped with reporting and analytics tools that help loan officers analyze data on leads, borrowers, and marketing performance. This insight aids in making data-driven decisions that can enhance business strategies and uncover opportunities for growth.

General Pricing of CRM Software for Loan Officers

CRM software for loan officers is a critical tool that comes with various pricing structures tailored to different needs. Typically, pricing plans are crafted to suit the range from individual loan officers to small businesses, and support features encompass these variations.

Individual Loan Officers: For solo practitioners, CRM software often offers a fixed pricing plan. For instance, services can start from $99 per user/month, with some providers offering essentials like contact management and email automation.

Small Businesses: As teams expand, so do the CRM requirements. Small business packages usually include advanced features like team collaboration tools and integration with loan origination systems (LOS). The cost for these systems can start at $148 per month and increase based on the number of team members and the depth of functionality required.

Pricing Plans:

- Basic: Starting at $99/user/month (Essential features for individuals)

- Team: From $148/month (Additional collaboration tools for small teams)

- Enterprise: Custom pricing (Comprehensive solutions for large teams)

Included in Most Plans:

- Contact Management

- Email Automation

- Task Management

- Phone Integration

Providers may offer tiered pricing, where more advanced features are locked behind higher-cost tiers. This often reflects a balance between functionality and price to maximize profit while delivering valuable services. It is advisable for loan officers to carefully consider the aspects of CRM software that are most crucial to their workflow and evaluate potential return on investment before selecting a plan.

Features to Look for In CRM Software for Loan Officers

When choosing a CRM for loan officers, certain features stand out as essential for managing client relationships and streamlining the loan origination process. A loan officer must look for a CRM that offers the following capabilities:

- Lead Management and Email Marketing: The CRM should have robust lead management tools to track and nurture leads through the sales funnel. It should also include email marketing features, allowing loan officers to create and automate outreach campaigns effectively.

- Document Management: Organizing and managing documents efficiently is key in the loan process. The CRM should provide a secure way to store and access all necessary documents, making it easier to manage loan applications and compliance documents.

- Loan Origination System (LOS) Integrations: The CRM should seamlessly integrate with popular LOS platforms. This integration ensures that the loan officer can easily transfer data between systems, reducing manual entry and potential errors.

- Automation and Workflow Customization: Automation tools in a CRM can save time by automating repetitive tasks, such as follow-ups and appointment scheduling. Additionally, customizable workflows allow loan officers to tailor their software to fit their unique process needs.

- User-Friendly Interface and Compliance: A user-friendly interface is crucial for adoption and efficiency. The CRM must also stay current with industry compliance standards to ensure that loan officers can rely on it to manage sensitive client information securely and legally.

Top Recommendations

Salesforce is a leading cloud-based CRM platform that empowers businesses to enhance customer relationships and drive growth.

Act! is a popular CRM software designed to help small & medium-sized businesses manage contacts and marketing efforts effectively.

Best CRM Software for Loan Officers

The best CRM solutions offer robust features such as sales automation, powerful analytics, and seamless regulatory compliance, helping loan officers to build trust with clients and close more deals.

Best CRM Software for Loan Officers (At a Glance)

| Software | Focus Area | Key Features | Best For |

|---|---|---|---|

| Salesforce Financial Services Cloud | Financial Services | Customizable financial services workflows, client management, analytics | Financial advisors, insurance companies, personalized banking |

| Zoho CRM | Sales and Marketing | Multichannel communication, automation, analytics, AI insights | Small to medium businesses looking for scalable solutions |

| HubSpot CRM | Inbound Marketing, Sales, and Service | Free CRM offering, marketing automation, customer service tools, integrations | Businesses of all sizes looking for an all-in-one CRM platform |

| Pipedrive | Sales Pipeline Management | Visual sales pipelines, email integration, activity reminders | Sales teams needing direct sales pipeline management tools |

| Microsoft Dynamics 365 for Sales | Sales and Customer Insights | Integration with Microsoft products, AI insights, customer data platform | Organizations requiring deep integration with Microsoft applications |

| Freshsales | Sales and Marketing Automation | AI-driven insights, email campaigns, chat, phone, automation | Small to medium businesses needing sales and marketing automation |

| Act! | CRM and Marketing Automation | Contact management, marketing automation, e-commerce solutions | Small businesses and entrepreneurs looking for a simple CRM |

| Capsule CRM | Ease of Use and Simplicity | Contact management, task management, sales pipeline | Small businesses seeking a straightforward and affordable CRM |

| Insightly | CRM and Project Management | Project management, lead routing, workflow automation | Small to mid-sized businesses needing CRM with project management |

| Maximizer CRM | Comprehensive Client Management | Client management, email marketing, business intelligence tools | Small to medium-sized businesses in need of robust client management |

| SugarCRM | Customizable CRM Solutions | Highly customizable, marketing automation, advanced reporting | Mid-sized to large businesses needing customizable CRM solutions |

| Less Annoying CRM | Simplicity and User-Friendliness | Simple contact management, task management, affordability | Small businesses and solopreneurs needing an easy-to-use CRM |

| Keap | Small Business Sales and Marketing | CRM, sales and marketing automation, payments processing | Small businesses looking for comprehensive sales and marketing tools |

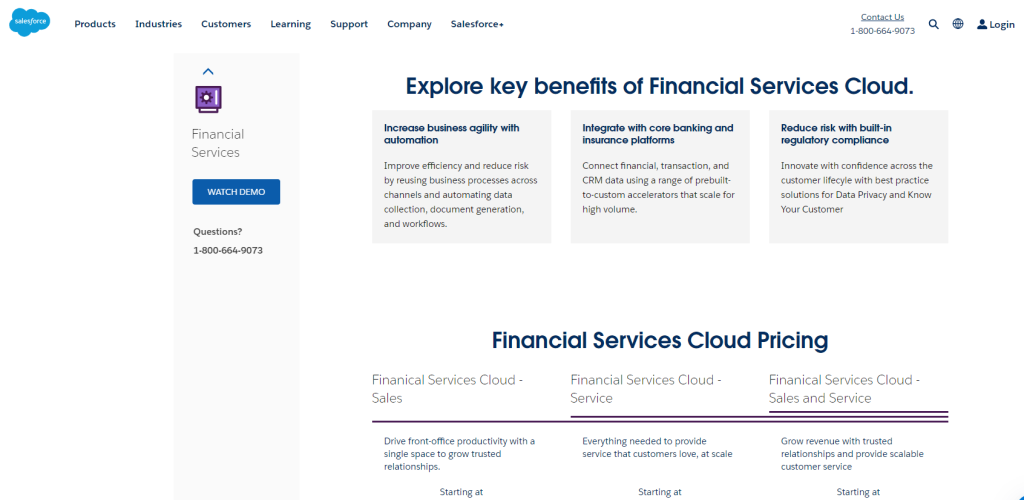

1. Salesforce Financial Services Cloud

Key Features:

- Sales automation and efficiency

- Comprehensive client support tools

- Regulation compliance assistance

Rating: 4.5/5

Pros:

- Highly customizable platform

- Strong focus on financial services industry

- Advanced analytics for performance tracking

Cons:

- Higher cost can be a barrier for some businesses

- Complexity may require more training

- Extensive features can be overwhelming

Pricing: Custom pricing based on individual business needs

Salesforce Financial Services Cloud is specifically designed for the financial sector, offering a robust set of features tailored to meet the unique needs of financial advisors, insurance companies, and personalized banking services.

It excels in providing customizable workflows, deep client management capabilities, and powerful analytics, making it possible to deliver personalized customer experiences at scale.

Its integration with the Salesforce ecosystem allows for a seamless experience across sales, service, and marketing, making it an indispensable tool for financial professionals seeking to enhance client relationships and drive growth.

Verdict: Salesforce Financial Services Cloud is a prime choice known for its deep customization and sophisticated client interaction capabilities.

Check out Salesforce Financial Services Cloud here!

2. Zoho CRM

Key Features:

- Lead nurturing and marketing campaigns

- Email marketing and automation

- Sales pipeline and contact management

Rating: 4.0/5

Pros:

- Affordable for small to medium-sized businesses

- Strong automation capabilities for sales and marketing

- Easy to implement and use

Cons:

- Can become expensive with add-ons

- Limited customization in lower-tier plans

- Occasional complaints about customer support

Pricing: Starts from $14/user/month (Standard) to $52/user/month (Ultimate)

Zoho CRM is a versatile platform that serves small to medium businesses looking for a scalable CRM solution. It offers multichannel communication, allowing businesses to connect with their customers via email, live chat, phone calls, and social media platforms.

With automation, analytics, and AI insights, Zoho CRM helps businesses streamline their sales processes, improve customer engagement, and make data-driven decisions.

Its affordability and customization options make it a popular choice for businesses aiming to grow and scale efficiently.

Verdict: Zoho CRM offers a balanced solution with its focus on marketing automation and affordability.

3. HubSpot CRM

Key Features:

- Marketing automation and email marketing

- Lead management and analytics

- Free tier available with essential CRM functions

Rating: 4.5/5

Pros:

- User-friendly interface enhances ease of use

- Powerful free plan suitable for many small businesses

- Excellent integrations with other tools

Cons:

- Premium features can be quite expensive

- Limited capability for complex customer service processes

- Could offer more advanced reporting in free tier

Pricing: Free tier available; paid plans start at $45/month

HubSpot CRM is renowned for its comprehensive, all-in-one platform that supports businesses of all sizes. It stands out for its free CRM offering, which includes marketing automation, customer service tools, and extensive integrations.

HubSpot’s ease of use and the ability to scale with a business as it grows make it an attractive option for companies looking to manage their marketing, sales, and service efforts in one place.

Its inbound marketing tools are particularly effective in attracting leads, engaging with customers, and delighting them over time.

Verdict: HubSpot CRM is acclaimed for it’s lead management proficiency and user-friendly experience.

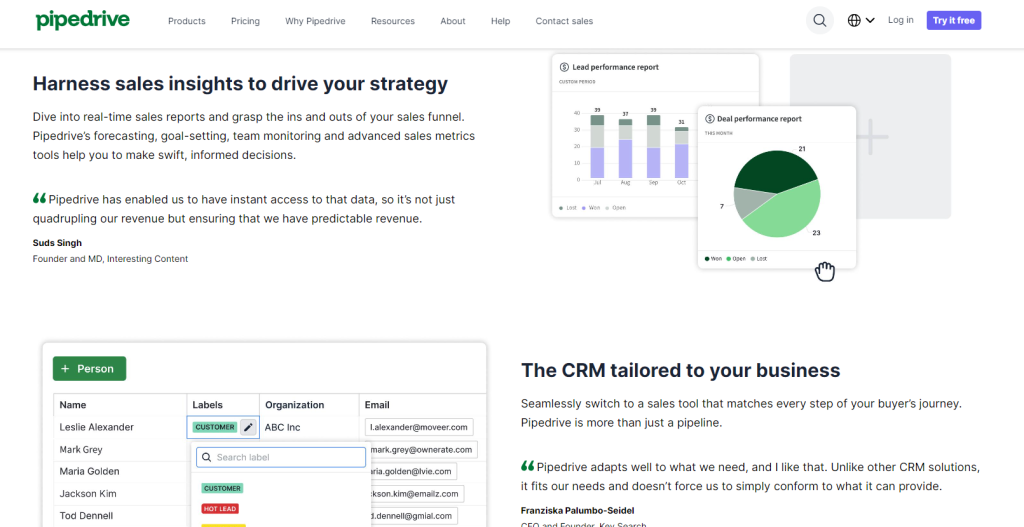

4. Pipedrive

Key Features:

- Sales pipeline visualization

- Deal management and automation

- Email integration and tracking

Rating: 4.0/5

Pros:

- Intuitive interface encourages adoption and utilization

- Strong focus on sales management features

- Good range of integrations for a complete sales cycle

Cons:

- Reporting may be too basic for some businesses

- Lacks native project management tools

- No free plan available

Pricing: Starts from $14.90/user/month for the Essential plan to $99/user/month for the Enterprise plan

Pipedrive focuses on sales pipeline management, offering a visual and intuitive interface that helps sales teams manage their deals and activities efficiently.

Its key features include email integration, activity reminders, and the ability to customize the sales pipeline to fit the sales process of any organization.

Pipedrive is best for sales teams that require a straightforward tool to manage direct sales processes, with an emphasis on simplicity and effectiveness in tracking sales progress.

Verdict: Pipedrive is a popular choice due to its practical and visual approach to the sales pipeline.

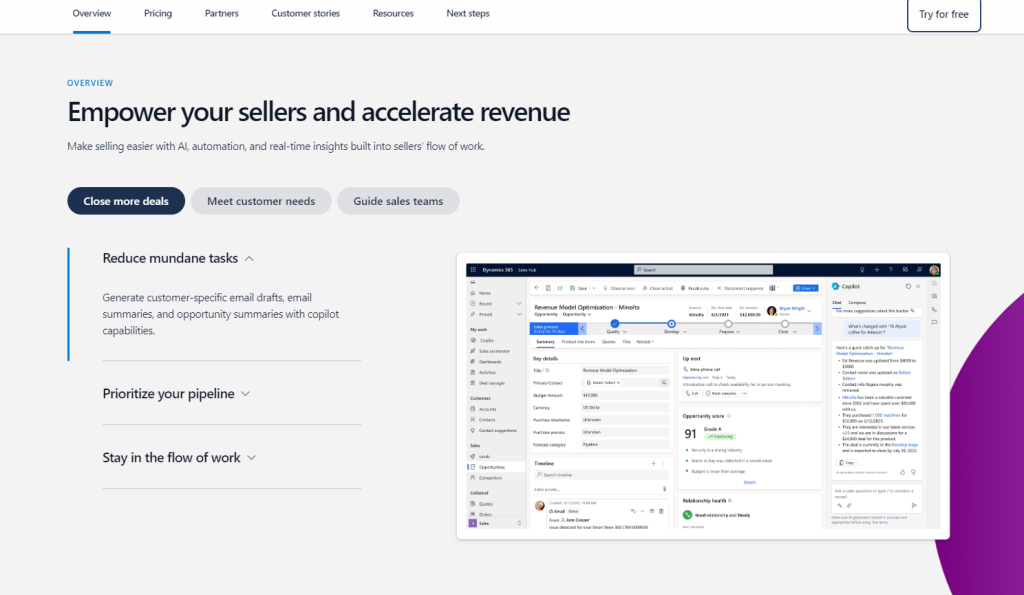

5. Microsoft Dynamics 365 for Sales

Key Features:

- Sales automation and productivity

- Detailed customer data insights

- Advanced customization and integrations

Rating: 4.2/5

Pros:

- Deep integration with other Microsoft products

- Strong automation across customer relationship activities

- Extensive data analytics capabilities

Cons:

- Can be complex to configure without technical knowledge

- Higher price point than some competitors

- Can entail additional costs for full feature set

Pricing: From $65/user/month for the Sales Professional plan

Microsoft Dynamics 365 for Sales is ideal for organizations that require deep integration with Microsoft applications.

It offers sales and customer insights, powered by AI, to help businesses understand customer needs, engage more effectively, and win more deals.

Its strength lies in its ability to leverage the Microsoft ecosystem, including Office 365 and LinkedIn, providing a unified experience that enhances productivity and collaboration within sales teams.

Verdict: Microsoft Dynamics 365 for Sales stands out with its advanced analytics and sales automation.

Check out Microsoft Dynamics 365 for Sales here!

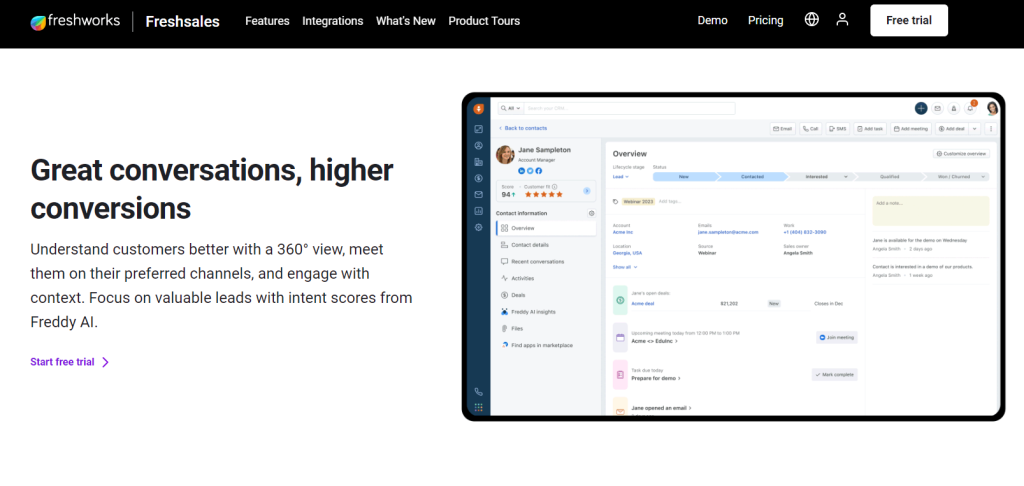

6. Freshsales

Key Features:

- Contact management and lead scoring

- Sales automation and email campaigns

- Artificial intelligence-based insights (Freddy AI)

Rating: 4.1/5

Pros:

- User-friendly interface for a smoother workflow

- Good email tracking and engagement features

- Strong AI capabilities for predictive sales insights

Cons:

- Some features require a learning curve

- Advanced reporting only in higher-tier plans

- Limited customization options

Pricing: Plans range from $15/user/month (Growth) to $69/user/month (Enterprise)

Freshsales, by Freshworks, is designed for small to medium businesses needing comprehensive sales and marketing automation.

It offers AI-driven insights, email campaigns, chat, phone, and automation tools to help businesses attract, engage, and delight customers.

Freshsales stands out for its user-friendly interface and all-in-one capabilities, making it a strong contender for businesses looking to consolidate their sales and marketing tools into a single platform.

Verdict: Freshsales distinguishes itself with a strong set of AI-driven features and ease of use.

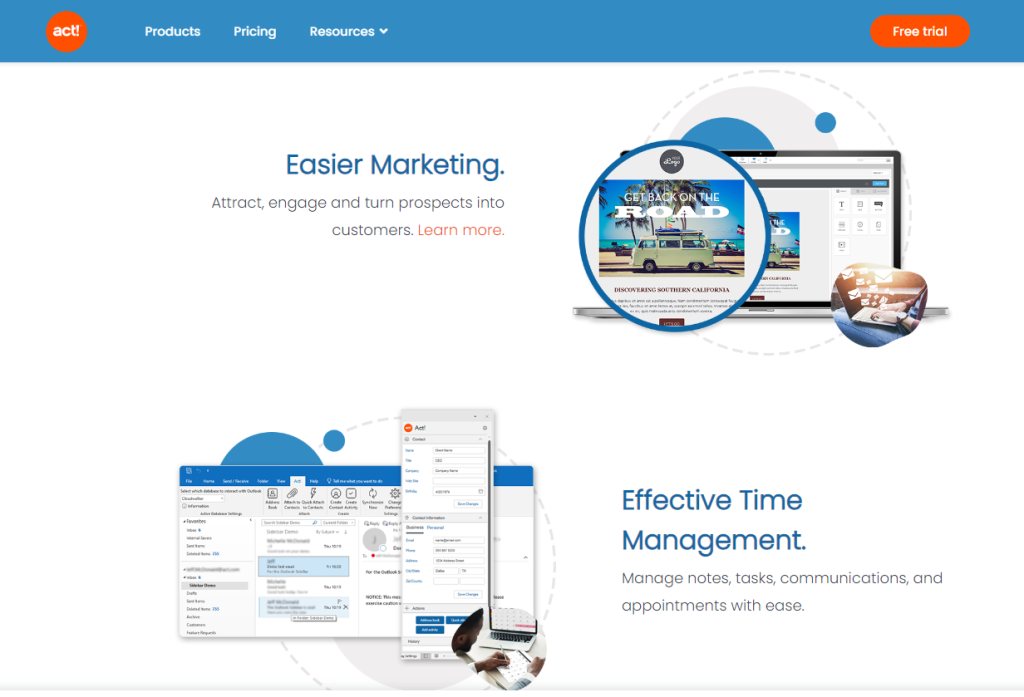

7. Act!

Key Features:

- Marketing automation and campaign management

- Contact management and activity tracking

- Customizable sales processes and reports

Rating: 3.8/5

Pros:

- Good range of marketing tools

- Extensive customization potential

- Offers both cloud and on-premise deployment options

Cons:

- May feel outdated compared to newer CRMs

- Customer support could be improved

- Interface is not as intuitive as some competitors

Pricing: Starts from $25/user/month for Essentials plan to $150/user/month for Ultimate plan

Act! is a CRM and marketing automation platform best suited for small businesses and entrepreneurs.

It offers contact management, marketing automation, and e-commerce solutions, all designed to help businesses grow their customer base and increase sales.

Act! is known for its simplicity and effectiveness, providing users with the tools they need to manage customer relationships and marketing efforts without the complexity often associated with more comprehensive CRM systems.

Verdict: Act! is versatile thanks to its mix of marketing and sales tools, appealing to those seeking extensive customizability.

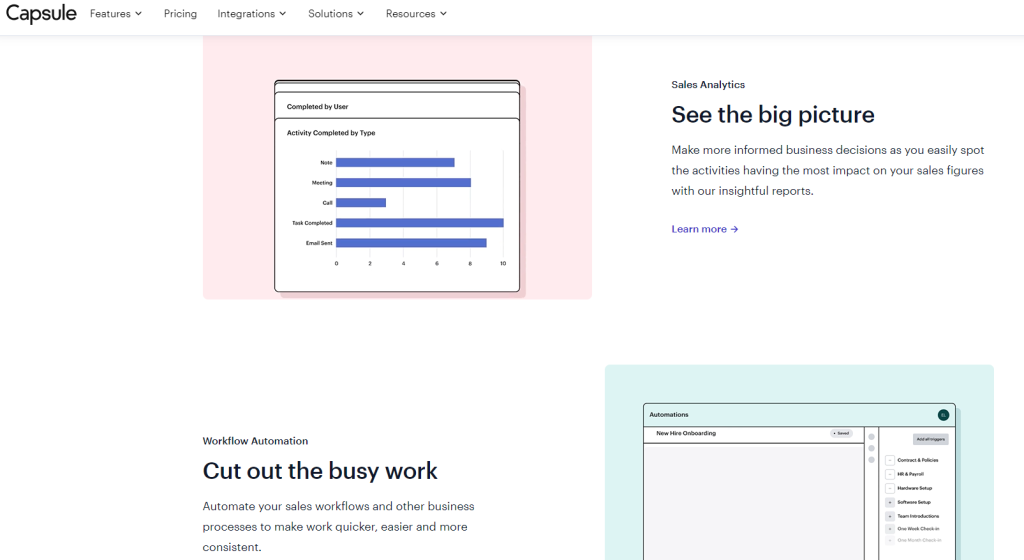

8. Capsule CRM

Key Features:

- Task management and organization

- Project management capabilities

- Simple and clean user interface

Rating: 4.0/5

Pros:

- Straightforward and easy to navigate design

- Portable contact management system

- Affordable for small businesses

Cons:

- Limited scope of functionality compared to others

- Not as robust in sales analytics

- Fewer automation options

Pricing: Free version available; Professional plan at $18/user/month

Capsule CRM offers a simple, effective CRM solution focused on ease of use and simplicity.

It’s designed for small businesses seeking a straightforward and affordable CRM to manage contacts, sales pipelines, and tasks.

Its strength lies in its simplicity, making it easy for teams to adopt and use without extensive training or customization, yet it still offers the essential features needed to track customer interactions and manage sales processes.

Verdict: Capsule CRM appeals to those looking for a no-fuss solution for managing customer relations and projects.

9. Insightly

Key Features:

- Project management with CRM integration

- Automated lead routing and workflow management

- Customizable data collection and reporting

Rating: 3.9/5

Pros:

- Unified view of customers and projects

- Good integration capabilities with G Suite and Microsoft Office

- Visual sales pipelines for easy tracking

Cons:

- Mobile app experience could be enhanced

- Learning curve for advanced features

- Limited customization without technical expertise

Pricing: Ranges from $29/user/month (Plus) to $99/user/month (Enterprise)

Insightly provides CRM and project management capabilities, making it a unique tool for small to mid-sized businesses that require both functionalities.

It offers project management, lead routing, and workflow automation, alongside traditional CRM features.

This makes Insightly a versatile platform for businesses looking to manage customer relationships and project delivery within the same tool, streamlining processes and improving efficiency.

Verdict: Insightly excels in bridging the gap between sales management, customer service, and project execution.

10. Maximizer CRM

Key Features:

- Customer journey mapping and personalization

- Comprehensive CRM with sales, marketing, and service modules

- Customization and automation tools

Rating: 3.7/5

Pros:

- All-in-one solution for customer relationship management

- Great at personalizing customer interactions

- Strong focus on customer journey analytics

Cons:

- User interface may feel less modern

- Can be costly when adding multiple modules

- Not the best option for very small businesses

Pricing: Around $55/user/month, specific pricing can vary based on customization

Maximizer CRM is tailored for small to medium-sized businesses in need of robust client management.

It offers a comprehensive suite of features including client management, email marketing, and business intelligence tools.

Maximizer CRM stands out for its deep customization options and extensive reporting capabilities, allowing businesses to tailor the platform to their specific needs and gain insights into their sales and customer engagement efforts.

Verdict: Maximizer CRM offers a full-bodied experience aimed at managing the entire customer lifecycle.

11. SugarCRM

Key Features:

- Sales automation and forecasting

- Advanced customer analytics

- Extensive customization capabilities

Rating: 4.1/5

Pros:

- Comprehensive reporting tools for data-driven decisions

- Focus on customer insight and analytics

- High level of flexibility and scalability

Cons:

- Can be overwhelming for CRM novices

- Initial setup requires time and expertise

- Cost may be a consideration for smaller teams

Pricing: Starting at $52/user/month for Sell plan

SugarCRM is designed for mid-sized to large businesses requiring customizable CRM solutions.

It offers a highly flexible platform with features such as marketing automation, advanced reporting, and a customizable interface.

SugarCRM’s strength lies in its ability to adapt to complex business processes and unique industry requirements, offering businesses the tools they need to create personalized customer experiences at scale.

Verdict: SugarCRM is suited for organizations that prioritize data analysis and require a high degree of customization.

12. Less Annoying CRM

Key Features:

- Simple contact management and customer tracking

- Task and lead management

- Straightforward pricing and usability

Rating: 4.3/5

Pros:

- Accessibly priced for a small business

- Extremely user-friendly platform

- Primarily designed for CRM beginners

Cons:

- Limited advanced features for larger businesses

- Basic reporting capabilities

- No tiered pricing or plans for scalability

Pricing: $15/user/month with a 30-day free trial

Less Annoying CRM is focused on simplicity and user-friendliness, making it an ideal choice for small businesses and solopreneurs.

It offers simple contact management, task management, and an affordable pricing model without sacrificing essential CRM functionalities.

Its ease of use and straightforward approach make it a popular choice for those new to CRM software or businesses with basic CRM needs.

Verdict: Less Annoying CRM stands out for providing straightforward CRM functionality without complexity.

Check out Less Annoying CRM here!

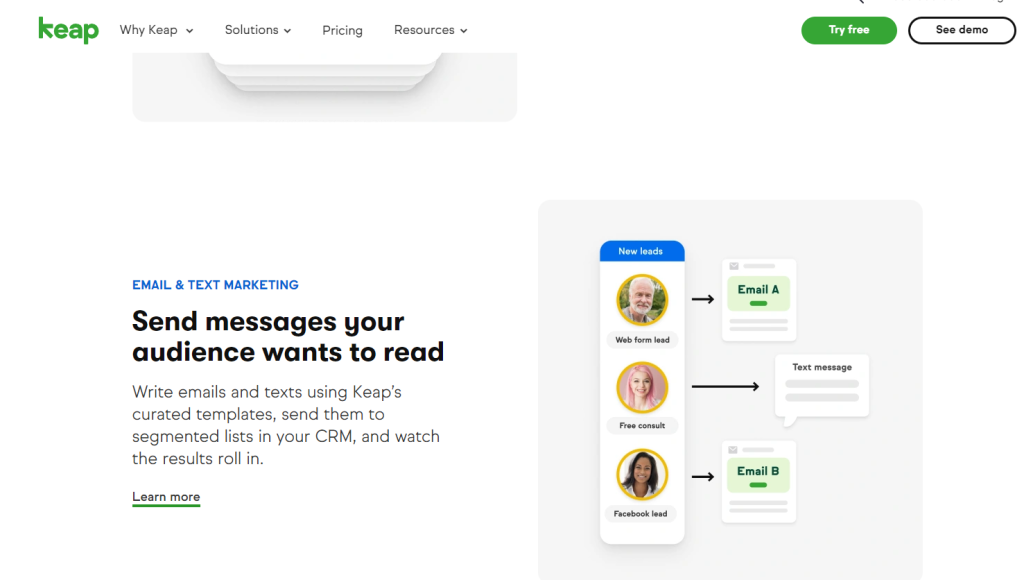

13. Keap

Key Features:

- Lead capture and marketing automation

- E-commerce capabilities

- Integrated sales and marketing in one platform

Rating: 4.0/5

Pros:

- Combines CRM with powerful marketing tools

- Suitable for small businesses with e-commerce needs

- Good for sales workflow automations

Cons:

- Interface may not be as intuitive as competitors

- Pricing can become steep with e-commerce features

- Some features may require additional purchases

Pricing: Lite plan starts at $56/month for 500 contacts

Keap (formerly Infusionsoft) is a comprehensive platform offering CRM, sales, and marketing automation tailored for small businesses.

It includes features such as lead capture, email marketing, and payments processing, integrated into a single platform.

Keap is known for its ability to help small businesses streamline their sales and marketing processes, improve customer engagement, and drive sales growth with its all-in-one solution.

Verdict: Keap is a versatile tool that integrates CRM with e-commerce and marketing, ideal for small to medium businesses.

FAQs

How can a CRM improve client management for loan officers?

A Customer Relationship Management (CRM) system can significantly enhance a loan officer’s ability to track client interactions, streamline communication, and automate follow-ups, leading to more organized and effective client management. By centralizing client information, a CRM makes it easier for loan officers to access and update client data, thus improving the accuracy and efficiency of the service provided.

Can a CRM software help with compliance and regulation challenges in mortgage lending?

CRM software can assist loan officers with compliance and regulatory requirements by ensuring all client interactions are logged and documents are stored securely. Features like automated reminders can help keep loan officers on top of important deadlines and ensure that consistent processes are followed, thus aiding in maintaining regulatory compliance.

What CRMs do top-producing loan officers recommend?

Top-producing loan officers often endorse CRMs that offer a blend of robust features, ease of use, and reliable support. Systems like Salesforce and Velocify are frequently recommended for their automation capabilities, lead management tools, and integrations with other software. They allow loan officers to work more efficiently and close more loans.